Three White Soldiers Candlestick Pattern in Trading

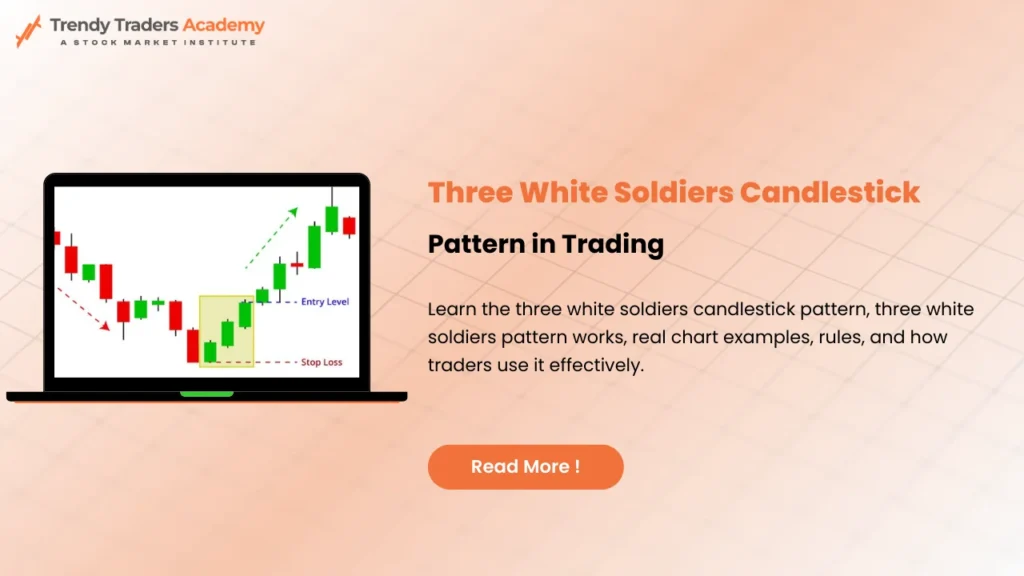

The candlestick patterns are important in technical analysis as they are graphical representations of the market psychology. The three white soldiers candlestick pattern is one of the most effective reversal patterns because it is the bullish reversal pattern. It indicates an evident reversal of the situation between sellers and buyers and in many cases, it is the start of a long-term upwards trend.

The traders engaged in equities, indices, commodities, and cryptocurrencies use this trend in large amounts. Scanners such as Chartink, TradingView and other platform often point out this formation because of the high bullish character of the formation. Nevertheless, it is necessary to know when and how to employ the three white soldiers pattern. It may give a misleading signal especially in a sideways market when it is blindly traded without confirmation.

This is a step-by-step guide to the three white soldiers candle pattern by Trendy Traders Academy, where we have outlined; what is the three white soldiers candle pattern, how to find it, actual chart, three white soldiers chartink, three white soldiers pattern examples, confirmation rules, most frequently used mistakes, and potential applications of the three white soldiers candle pattern in a disciplined trading strategy.

What is Three White Soldiers Candlestick Pattern?

The three white soldiers candlestick pattern is a powerful bullish reversal signal which is made up of three long-bodied bullish candles that follows a decline. It is a measure of long term purchasing power, and is commonly applied by traders in order to detect reversal of trends with certainty.

Each candle:

- Opens within or near the previous candle’s body

- Closes progressively higher

- Shows strong buying pressure with relatively small wicks

This pattern typically appears after a downtrend or consolidation phase and signals that buyers are gaining control.

Key Characteristics

- Three consecutive bullish candles

- Higher closes each session

- Strong candle bodies

- Minimal upper shadows

- Appears near a support or after decline

Psychology Behind the Three White Soldiers Pattern

Understanding the psychology makes the pattern more reliable.

Day-by-Day Market Behavior

- First candle: Buyers step in after prolonged selling

- Second candle: The confidence is generated as buyers increase the price further.

- Third candle: Momentum traders come in, which validates reversal of the trend.

This sequence is a sign of long-term demand rather than short covering.

Three White Soldiers Candle Pattern Formation Rules

- Appears after a downtrend or correction

- Each candle opens within the previous candle’s body

- Each candle closes near its high

- No long upper wicks

- Volume ideally increases gradually

Failure to meet these rules reduces reliability.

Three White Soldiers vs Similar Bullish Patterns

Three White Soldiers vs Bullish Engulfing

- Bullish engulfing: One candle

- Three white soldiers: Multi-candle confirmation

- Reliability: Higher for three white soldiers

Three White Soldiers vs Morning Star

- Morning star: Three candles with indecision

- Three white soldiers: Strong directional move

- Momentum: Stronger in three white soldiers

Three White Soldiers Pattern Examples

Example 1: Equity Stock Reversal

A stock declines steadily for several sessions and forms a base near a support zone. Suddenly, three consecutive bullish candles appear with increasing volume.

Interpretation:

- Selling pressure exhausted

- Institutional buying begins

- Probability of trend reversal increases

Example 2: Index Chart on Daily Timeframe

On a daily index chart, after a 6-8% correction, three white soldiers form above a major moving average.

Outcome:

- Index resumes uptrend

- Higher highs follow over the next sessions

This is a classic trend continuation after a correction use case.

Example 3: Three White Soldiers Chartink Scanner

Many traders use three white soldiers Chartink scans to find bullish reversal candidates.

Typical scan logic:

- Last 3 candles bullish

- Higher closes

- Strong body size

- Prior candles bearish

These three white soldiers pattern examples help traders shortlist high-probability setups quickly.

How to Trade the Three White Soldiers candle Pattern?

Entry Strategy

- Enter near the close of the third candle

- Or wait for a minor pullback for better risk-reward

Stop Loss Placement

- Below the low of the first candle

- Or below recent swing low

Target Setting

- Nearest resistance level

- Risk-reward minimum of 1:2

- Trailing stop for trending moves

Confirmation Indicators to Use With Three White Soldiers

Never rely on candlestick patterns alone.

Best Confirmation Tools

- Volume expansion

- RSI above 40–50

- MACD bullish crossover

- Support zone confluence

- Moving average reclaim

When combined, the success rate improves significantly.

When the Three White Soldiers candle Pattern Fails?

Common Failure Scenarios

- Appears after a sharp vertical rally

- Forms near strong resistance

- Low volume participation

- Occurs in sideways markets

Professional traders always check context before acting.

Three White Soldiers in Different Markets

In Equity Trading

- Works best on daily and weekly charts

- Strong near long-term support levels

In Intraday Trading

- Lower reliability

- Best on higher timeframes like 15-min or 30-min

In Crypto Markets

- Works well due to momentum nature

- Volume confirmation becomes crucial

Advantages of the Three White Soldiers candle Pattern

- Clear bullish signal

- Easy to identify visually

- Reflects strong buyer dominance

- Suitable for swing and positional trading

Limitations of the Pattern

- Can appear late in the move

- Risk-reward may reduce without pullback

- Requires confirmation for consistency

How Trendy Traders Academy Teaches This Pattern?

At Trendy Traders Academy, traders learn:

- Pattern + price action combination

- Risk-based execution

- Market structure analysis

- Real-time Chartink scans

- Psychology behind reversals

The focus is not just pattern recognition but probability-based trading.

Conclusion

One of the strongest bullish reversal patterns of technical analysis is the three white soldiers candlestick pattern. It is a drastic change in the market mood where buyers dominate sellers in a series of sessions. It has high-probability trading opportunities when detected properly and used in conjunction with volume, support zones and trend confirmation.

Nevertheless, similar to all technical patterns, it is not infallible. Effective traders know that it is context, confirmation and risk management that are important and not the pattern itself. The three white soldiers pattern can be an effective addition to the trading headache of traders by ensuring the three white soldiers chartink disciplined execution and not prediction.

At Trendy Traders Academy, we focus on teaching the technical and psychological sides of the trade in order to enable the traders to attain consistency in the long run.

Also Download : Trendy Traders Academy’s Candlestick Patterns PDF.

Bullish, bearish, neutral, continuation, and reversal patterns help traders identify market direction, momentum, and possible trend changes. | |

Signals a possible bullish reversal after a downtrend as buyers reject lower prices. | |

Inverted Hammer Candlestick Pattern | Signals a possible bullish reversal after a downtrend as buyers reject lower prices. |

Indicates potential bullish reversal where buying pressure appears after a decline. | |

Patterns that indicate buying strength and possible upward trend reversal or continuation. | |

Patterns that signal selling pressure and a potential downward trend reversal. | |

A bullish reversal pattern where buyers regain control after a strong bearish move. | |

Warns of a possible bearish reversal after an uptrend due to selling pressure. | |

Shooting Star Candlestick Pattern | Indicates bearish reversal when price rejects higher levels after an uptrend. |

Signals a bullish reversal using a three-candle structure after a downtrend. | |

Indicates a bearish reversal at the top using a three-candle formation. | |

A bearish reversal pattern where sellers enter strongly after a bullish move. | |

Three Black Crows Pattern | Confirms strong bearish momentum with three long consecutive bearish candles. |

Doji Candlestick Pattern | Shows market indecision where buyers and sellers are equally balanced. |

Marubozu Candlestick Pattern | Represents strong momentum with no price rejection, indicating trend continuation. |

Reflects uncertainty and loss of momentum in the current trend. | |

A smoothed candlestick method that reduces market noise and helps traders clearly identify trends. |

FAQ'S

What is the three white soldiers candlestick pattern?

It is an overturning pattern of the bullish market characterized by three successive strong bullish candles that show the dominance of the buyers.

Is the three white soldiers pattern reliable?

Yes, especially when confirmed with volume and support zones.

Can beginners trade the three white soldiers candle pattern?

Yes, due to its simple structure and clear rules.

Does the pattern work on intraday charts?

It works better on higher timeframes; intraday use requires confirmation.

Is Chartink useful for finding this pattern?

Yes, Chartink scanners are commonly used to identify three white soldiers setups.