Doji Candlestick Pattern Meaning, 5 Types, Examples

Some candlestick patterns shout. Others whisper. The Doji candlestick type is categorically under the second group. On the face of it a Doji appears to be just a thin body with shadows on either side. Yet there is an eye of experience that this little candle may have a message.

A Doji is the creation of an opening and closing of the market at almost the same price. That mere fact is indicative that something significant was going on: neither the buyers nor the sellers could assume power. This hesitation can be seen in the market near turning points and thus the Doji is an invaluable early warning indicator in trending markets.

The Doji is common in Indian stock markets with sentiment shifting rapidly on news, global information, or institutional trading, so it is common in the stock market, index market and intraday market. This guide will deconstruct the meaning of a Doji, discuss the various types of Doji candles, describe the psychology of Doji candle pattern, and demonstrate the ways traders can use the Doji patterns in a responsible manner and not in a blind manner.

What is a Doji candlestick pattern?

Doji occurs when there are only slight differences between open price and close price. The actual body is small or almost non-existent, and the candle itself can still be characterized by long upper and lower shadows.

In simple terms:

- Buyers pushed prices up

- Sellers pushed prices down

- Neither side won

That balance of power is what defines a Doji.

Why does the Doji candle pattern matter?

Markets move because of imbalance-either buyers dominate or sellers dominate. A Doji signals balance or indecision, which is unusual during strong trends.

This makes the Doji important because:

- It can mark exhaustion in an existing trend

- It often appears near support or resistance

- It warns traders to slow down and reassess

A Doji does not predict direction by itself. It highlights uncertainty.

The Psychology Behind the Doji Pattern

Understanding the psychology makes the pattern far more useful than memorising shapes.

During a Doji session:

- Buyers attempt to move price higher

- Sellers respond and push it lower

- Both sides fail to dominate

- The session ends near the opening price

This tug-of-war shows hesitation. After a strong move, hesitation often precedes either a reversal or consolidation.

Doji in an Uptrend

When a Doji appears after an uptrend, it suggests:

- Buyers may be losing momentum

- Profit booking could be starting

- Upside conviction is weakening

In Indian markets, Dojis near all-time highs or resistance zones often lead to sideways movement or short-term pullbacks rather than immediate crashes.

Doji in a Downtrend

In a downtrend, a Doji indicates:

- Selling pressure may be slowing

- Buyers are beginning to show interest

- Panic selling could be exhausting

This is why many traders watch for Dojis near support levels during falling markets.

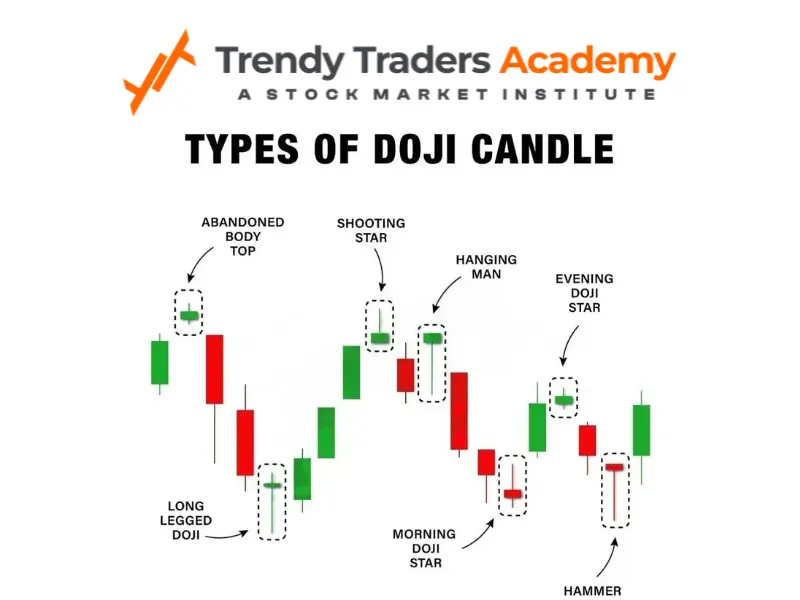

Types of Doji Candles

Not all Dojis look the same. The types of Doji candles add nuance to interpretation.

1. Classic Doji

- Very small body

- Upper and lower shadows of similar length

This reflects pure indecision and is the most common Doji.

2. Long-Legged Doji

- Very long upper and lower shadows

- Open and close near the middle

This shows extreme volatility but no winner. Often appears during uncertainty or news-driven sessions.

3. Dragonfly Doji

- Long lower shadow

- Little or no upper shadow

- Close near the high

This indicates buyers rejected lower prices strongly. It is often seen near market bottoms.

4. Gravestone Doji

- Long upper shadow

- Little or no lower shadow

- Close near the low

This suggests rejection of higher prices and often appears near market tops.

5. Four-Price Doji

- Open, high, low, close almost identical

- Rare and usually seen in illiquid markets

It has limited practical trading value.

Doji Candlestick Patterns vs Other

Doji candle pattern vs Spinning Top pattern

Feature | Doji | |

Body size | Almost zero | Small but visible |

Meaning | Strong indecision | Mild indecision |

Importance | Higher | Moderate |

A Doji shows stronger hesitation than a spinning top.

Indian Market Example: Index Context

Imagine NIFTY rallies steadily for several sessions and forms a gravestone Doji near a resistance zone.

What often happens next?

- Traders book profits

- Index enters consolidation

- Short-term correction or sideways movement

The Doji doesn’t cause the move-it warns of changing sentiment.

Indian Stock Example: Stock-Level Behaviour

A mid-cap stock falls sharply over weeks and forms a dragonfly Doji near support.

This often leads to:

- Short covering

- Relief rally

- Reduced selling pressure

The Doji marks hesitation, not instant reversal.

Confirmation: The Golden Rule of Trading Dojis

A Doji candle pattern must always be confirmed.

Confirmation includes:

- A strong bullish candle after a Doji in a downtrend

- A strong bearish candle after a Doji in an uptrend

- Volume expansion in the confirmation candle

Trading Dojis without confirmation is one of the most common beginner mistakes.

How Traders Actually Use the Doji Pattern?

Entry Logic

- Wait for the next candle to show direction

- Enter only after confirmation

- Avoid trading Dojis in isolation

Stop Loss Placement

Stop Loss are usually placed:

- Below the Doji low (for bullish setups)

- Above the Doji high (for bearish setups)

This keeps risk clearly defined.

Profit Targets

Targets depend on:

- Nearest support or resistance

- Moving averages

- Recent swing points

Doji-based trades work best with conservative expectations.

Doji in Intraday Trading

In intraday charts:

- Works best on 15-minute and higher timeframes

- Strong near VWAP or day highs/lows

- Useful after sharp intraday moves

Intraday Dojis often signal pauses before continuation or reversal.

Doji in Swing Trading

Swing traders focus on:

- Daily and weekly Dojis

- Key price levels

- Confirmation over 1–3 sessions

Weekly Dojis near major levels often signal trend slowing rather than instant reversal.

Common Mistakes Traders Make with Doji Candlestick Pattern

- Treating every Doji as reversal

- Ignoring trend context

- Trading without confirmation

- Using tight stop losses

- Overtrading Dojis in sideways markets

A Doji is a warning sign, not a trade signal by itself.

How Reliable Is the Doji Pattern?

The Doji is not predictive-it is diagnostic.

It works best when:

- Combined with trend analysis

- Seen near key levels

- Confirmed by subsequent price action

Professional traders use Dojis to manage risk and timing, not to predict exact tops or bottoms.

Doji in Algorithmic & Systematic Trading

In systematic trading, Dojis can be defined objectively:

- Open–close difference thresholds

- Wick length ratios

- Trend filters

Platforms like Quanttrix.io allow traders to test Doji-based rules across years of data. This helps determine whether a Doji truly adds edge or simply looks good visually.

Who Should Use the Doji Pattern?

- Price-action traders

- Swing traders

- Intraday traders

- Algo traders using pattern filters

The Doji suits traders who value patience, confirmation, and context.

Why Should Beginners Learn About Doji Candles?

The Doji teaches:

- Market psychology

- Discipline and patience

- Importance of confirmation

- Respect for trend context

Even recognising a Doji can help beginners avoid emotional decisions.

Conclusion

The Doji candlestick pattern is small but big. It captures times when the market is put on hold, doubts itself, and makes choices on whether to move-on or take a different path. The slowing of markets is the first move that can be noticed in fast moving markets indicating that something is changing under the water.

The Doji assists traders to decelerate, insure the profits, and wait until clarity. With improper use, it is simply another confusing figure in a chart. The distinction is in the context, confirmation and discipline.

Markets reward those who listen carefully. The Doji doesn’t shout-but for those who understand it, it speaks clearly.

Also Download : Trendy Traders Academy’s Candlestick Patterns PDF.

Check more Candlestick Patterns

Bullish, bearish, neutral, continuation, and reversal patterns help traders identify market direction, momentum, and possible trend changes. | |

Signals a possible bullish reversal after a downtrend as buyers reject lower prices. | |

Indicates potential bullish reversal where buying pressure appears after a decline. | |

Patterns that indicate buying strength and possible upward trend reversal or continuation. | |

Patterns that signal selling pressure and a potential downward trend reversal. | |

A bullish reversal pattern where buyers regain control after a strong bearish move. | |

Confirms a strong bullish trend with three consecutive long bullish candles. | |

Warns of a possible bearish reversal after an uptrend due to selling pressure. | |

Indicates bearish reversal when price rejects higher levels after an uptrend. | |

Signals a bullish reversal using a three-candle structure after a downtrend. | |

Indicates a bearish reversal at the top using a three-candle formation. | |

A bearish reversal pattern where sellers enter strongly after a bullish move. | |

Three Black Crows Pattern | Confirms strong bearish momentum with three long consecutive bearish candles. |

Marubozu Candlestick Pattern | Represents strong momentum with no price rejection, indicating trend continuation. |

Reflects uncertainty and loss of momentum in the current trend. | |

A smoothed candlestick method that reduces market noise and helps traders clearly identify trends. |

FAQ'S

What is a Doji candlestick pattern?

A candle where open and close prices are nearly equal.

Is the Doji candle pattern bullish or bearish?

Neither-it signals indecision.

Can Doji indicate reversal?

Yes, when confirmed and in the right context.

Which Doji is most powerful?

Dragonfly and gravestone Doji near key levels.

Is Doji reliable in intraday trading?

Yes, on higher intraday timeframes.