Marubozu Candlestick Pattern: Meaning, 2 Types Full Guide

In price action trading, some candles speak louder than others. The Marubozu candlestick pattern is one such candle that clearly shows who is in control of the market-buyers or sellers. Unlike indecision candles such as Doji, a Marubozu reflects pure strength and conviction.

When this candle appears on a chart, it often marks the beginning of strong momentum or confirms an existing trend. Many traders spot Marubozu candles but fail to understand their real meaning, context, and limitations. A Marubozu is not just a long candle; it represents aggressive participation from one side of the market.

This detailed guide breaks down what a Marubozu candle pattern is, bullish Marubozu, bearish Marubozu, Marubozu candle types, its psychology, and how it can be traded responsibly. Doesn’t matter if you want to trade intraday or positional this pattern can significantly enhance your clarity.

What is Marubozu Candlestick Pattern?

A Marubozu pattern is a pattern characterized by a candle having no upper or lower shadow, or extremely small wicks. It is the opening and closing price of the session which is on one extreme and the other extreme.

- No visible wicks or very small wicks

- Strong directional movement

- Indicates full control by buyers or sellers

- Signals momentum and conviction

The word Marubozu comes from Japanese, meaning “bald” or “shaven,” referring to the absence of shadows.

Psychology Behind the Marubozu Candle Pattern

Understanding psychology makes this pattern far more powerful.

Bullish Marubozu Psychology

- Buyers dominate from the opening bell

- Price keeps rising without meaningful pullback

- Sellers fail to push price lower at any point

- Indicates strong demand and confidence

Bearish Marubozu Psychology

- Sellers take control from the start

- Price keeps falling without recovery

- Buyers are completely overpowered

- Indicates panic selling or strong distribution

In both cases, the market shows clear intent, unlike indecision patterns.

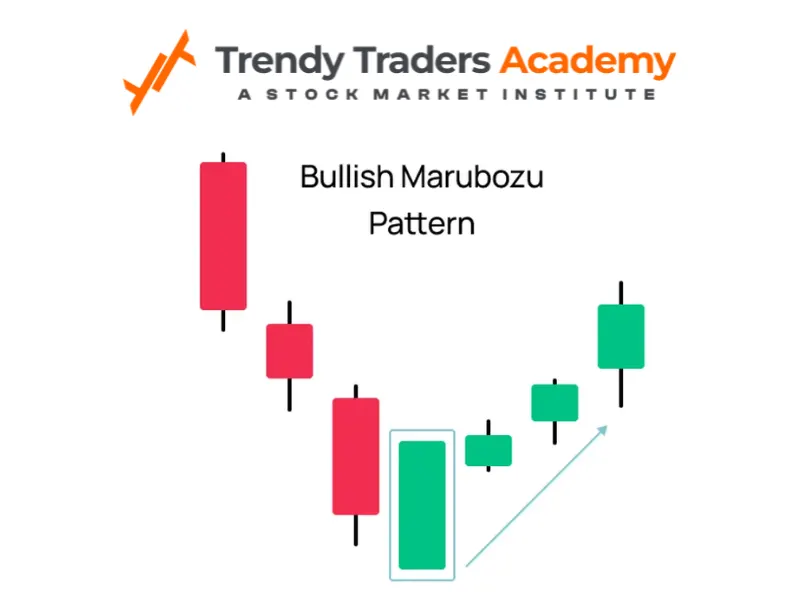

Bullish Marubozu Explained

A bullish is a long green (or white) candle with little to no shadows.

Structure

- Open = Low

- Close = High

- Large real body

What It Indicates?

- Strong buying interest

- Buyers in full control

- Continuation or start of an uptrend

When It Works Best?

- After consolidation

- Near support levels

- During breakout from resistance

- With rising volume

A Marubozu bullish often attracts momentum traders and institutional participation.

Bearish Marubozu Explained

A bearish Marubozu is a long red (or black) candle with no shadows.

Structure

- Open = High

- Close = Low

- Large real body

What It Indicates?

- Strong selling pressure

- Sellers dominate the session

- Continuation or start of a downtrend

When It Works Best?

- Near resistance zones

- After distribution phases

- During breakdown from support

- With increasing volume

Marubozu Bearish candles are commonly seen during panic or trend acceleration.

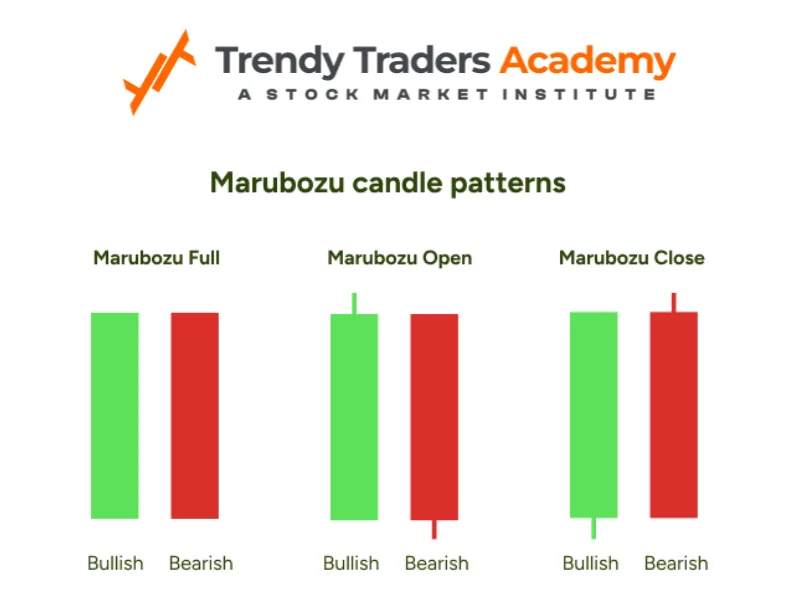

Marubozu Candle Types

1. Full Marubozu

- No upper or lower shadow

- Strongest form of Marubozu

- Shows absolute control

Reliability: Very high

2. Opening Marubozu

- No shadow on the opening side

- Small shadow on the closing side

Meaning: Strong start, slight profit booking near close

3. Closing Marubozu

- No shadow on the closing side

- Small shadow on the opening side

Meaning: Momentum strengthened into the close

4. Near Marubozu

- Very small shadows on both sides

- Still shows dominance

Meaning: Slight hesitation, but trend strength remains

Marubozu Candle Pattern vs Other Patterns

Pattern | Market Message | Strength |

Marubozu | Strong dominance | Very High |

Doji | Indecision | Medium |

Hammer | Reversal attempt | High |

Engulfing | Trend reversal | High |

Spinning Top | Weak momentum | Low |

Marubozu is one of the clearest momentum indicators in candlestick analysis.

Where Marubozu Candle Pattern Works Best?

1. Trend Continuation

- Appears during strong trends

- Confirms trend strength

2. Breakout Trading

- Forms during range breakouts

- Signals institutional participation

3. Retest and Go Setup

- Appears after retest of support or resistance

- Confirms continuation

4. News or Event-Based Moves

- Seen during results, policy announcements, or global cues

How to Trade Marubozu Candlestick Pattern?

Step 1: Identify the Market Context

Marubozu works best in trending or breakout markets, not in choppy ranges.

Step 2: Check Volume

High volume validates the strength of the Marubozu candle.

Step 3: Trade the Continuation

- Enter on small pullback

- Or enter on break of Marubozu high/low

Step 4: Stop-Loss Placement

Stop-loss takes place when:

- Below the low for bullish Marubozu

- Above the high for bearish Marubozu

Step 5: Target Setting

- Use previous resistance/support

- Or trail stop-loss with moving average

Example: Bullish Marubozu in Stock Trading

Assume a stock consolidates between ₹480–₹500 for two weeks. One day, it breaks above ₹500 with a Marubozu bullish and above-average volume.

This indicates:

- Breakout confirmation

- Strong buyer participation

- Higher probability of trend continuation

Such setups often lead to sustained moves if market sentiment supports them.

Marubozu Candlestick Pattern with Indicators

Marubozu candle pattern becomes even more reliable when combined with indicators:

- Moving Averages: Trend confirmation

- RSI: Strength or overbought context

- Volume: Conviction validation

- VWAP: Intraday momentum alignment

A bullish Marubozu above key moving averages often signals trend acceleration.

Marubozu in Intraday Trading

- Clear direction

- Fast momentum

- Suitable for breakout strategies

- False signals in low volume

- Risky near market open without confirmation

Best used with VWAP, volume, and higher timeframe bias.

Marubozu in Swing Trading

- Strong continuation signal

- Better risk-reward

- Less noise

Daily and weekly Marubozu candles carry far more weight than lower timeframes.

Common Mistakes Traders Make with Marubozu

- Chasing price after extended move

- Ignoring volume confirmation

- Trading Marubozu in sideways markets

- Placing tight stop-loss near entry

Understanding context prevents most losing trades.

Marubozu vs Fake Breakouts

Yes, but with discipline.

Beginners should:

- Trade on higher timeframes

- Avoid late entries

- Combine with trend analysis

- Practice risk management

This aligns with structured trading education taught at Trendy Traders Academy.

Common Mistakes Traders Make with Marubozu

Not every Marubozu leads to continuation.

Red flags include:

- Low volume

- Occurrence at major resistance without follow-through

- Immediate rejection next candle

Always wait for confirmation and follow-through.

Conclusion

The Marubozu candlestick pattern reflects clear market dominance and strong intent from either buyers or sellers. Unlike candles that signal hesitation, it leaves little doubt about who controls price movement. When applied with the right context, it allows traders to spot momentum-driven moves, trend continuation, and breakout opportunities more effectively.

The real advantage, however, comes not from simply recognizing the candle, but from understanding its placement and the conditions under which it forms. Marubozu signals become far more reliable when supported by volume analysis, prevailing trend structure, and important price zones.

With this pattern, the proper confirmation, and high-level risk management, the traders are usually more reliant on the results. With time, it is easier to learn the Marubozu candle types to enhance price-action and enhance the overall trading judgment.

Also Download : Trendy Traders Academy’s Candlestick Patterns PDF.

Check more Candlestick Patterns

Bullish, bearish, neutral, continuation, and reversal patterns help traders identify market direction, momentum, and possible trend changes. | |

Signals a possible bullish reversal after a downtrend as buyers reject lower prices. | |

Indicates potential bullish reversal where buying pressure appears after a decline. | |

Patterns that indicate buying strength and possible upward trend reversal or continuation. | |

Patterns that signal selling pressure and a potential downward trend reversal. | |

A bullish reversal pattern where buyers regain control after a strong bearish move. | |

Confirms a strong bullish trend with three consecutive long bullish candles. | |

Warns of a possible bearish reversal after an uptrend due to selling pressure. | |

Indicates bearish reversal when price rejects higher levels after an uptrend. | |

Signals a bullish reversal using a three-candle structure after a downtrend. | |

Indicates a bearish reversal at the top using a three-candle formation. | |

A bearish reversal pattern where sellers enter strongly after a bullish move. | |

Three Black Crows Pattern | Confirms strong bearish momentum with three long consecutive bearish candles. |

Reflects uncertainty and loss of momentum in the current trend. | |

A smoothed candlestick method that reduces market noise and helps traders clearly identify trends. |

FAQ'S

What is Marubozu candlestick?

A Marubozu is a candle that has small or no shadows, which means that there is a strong buyer or seller control.

May we have long and short trades with Marubozu?

This may be bullish or bearish according to whether the candle is in an upward or a downward direction.

What is the strongest Marubozu candle?

The strongest type of Marubozu has no wicks.

Is it possible to use Marubozu to engage in intraday trading?

Yes, particularly when the quantity of the breakout is large.

What are the 2 Marubozu candle types?

2 Marubozu candle types are Bullish Marubozu and Bearish Marubozu.

Is Marubozu reliable for beginners?

Yes, if traded with confirmation, trend analysis, and risk control.