Types of Candlestick patterns

Candlestick patterns are a main trading tool used by experts and financiers. They show the highs and lows of market value, which aids in decision-making and the recognition of emerging patterns.

Key Takeaways

- Candlestick patterns are visually attractive representations of market data that supply important insights about price changes.

- Making clever trading options requires a thorough understanding of the numerous candlestick patterns.

- You can have a benefit over rivals in the financial markets by being proficient in candlestick evaluation.

- Candlestick patterns may aid you spot new patterns and market situations.

- Profitable and well-planned trading strategies can result from utilizing the power of candlestick analysis.

Understanding the Significance of Candlestick Patterns

Candle patterns were first utilized in Japan in the 18th century. For traders worldwide, these charts are currently necessary resources. They offer comprehensive understandings of technical analysis and market patterns.

The History of Candlestick Charts

Japanese rice trader Munehisa Homma invented candlestick Patterns in the 18th century. He recognised the potential of visual patterns to forecast market movements. His research study modified investors’ perceptions of candlestick background and their usage in candlestick patterns.

Why Candlestick Patterns Matter in Technical Analysis

Technical analysis focuses heavily on candlestick patterns. They support traders in identifying market patterns and making wise decisions. They aid in the identification of support and resistance levels by traders as well as potential market reversals. Price changes are easy to observe thanks to these trends.

“Candlestick patterns are a powerful tool in the trader’s arsenal, offering a unique window into the psychology of the market.”

Candlesticks and Patterns: Unveiling the Most Common Ones

Candlestick patterns originate from candlestick charting, an old Japanese technique. Common candlestick patterns are crucial in the trading business. They provide us hints about market feelings and where prices might move next. Gaining an understanding of these candlestick patterns can revolutionize your trading strategies and analysis.

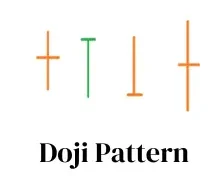

A popular pattern that indicates uncertainty in the market is Doji. When the opening and closing prices are nearly equal, it occurs. This may indicate an impending shift in the trend. A green candle covering a red one, indicating an uptrend, is one of the other patterns known as the Bullish Engulfing. Additionally, there is the Bearish Engulfing, which signals a potential market decline.

At Trendy Traders Academy, we think it’s key to master candlestick analysis. Our detailed training covers these common candlestick patterns. We give you the tools to understand market signals well. Come join us and learn the secrets of candlestick charting.

1. Single Candlestick Patterns

- Doji: A candlestick that shows indecision when the opening and closing prices are almost identical.

- Hammer: A candlestick with a lengthy bottom shadow and a short body that may indicate a reversal following a downward trend.

- Hanging Man: is a symbol of a possible reversal that resembles the Hammer but emerges following an upward trend.

- Shooting star: has a short upper shadow and a small body, suggesting that an uptrend may be about to reverse.

- Inverted hammer: has a small body and a long upper shadow, suggesting that a downtrend may be about to reverse.

- Spinning Top: A candlestick that represents market indecision with a small body and extended shadows on both sides.

2. Double Candlestick Patterns

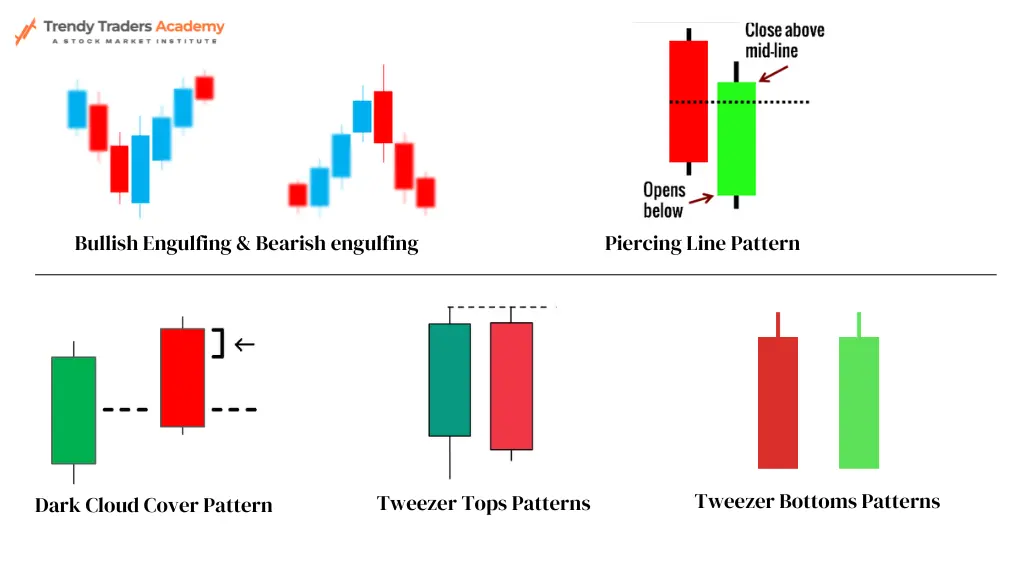

- Bullish Engulfing: A two-candle pattern that indicates a possible bullish reversal when a big green (or bullish) candle engulfs the preceding small red (or bearish) candle.

- Bearish engulfing : A bearish reversal may be indicated by a Bearish engulfing pattern, which consists of a small green candle that is bullish and a large red candle that is bearish, engulfing the preceding candle.

- Piercing Line: A two-candle pattern in which a bullish candle begins below the first candle’s low and closes above its midpoint, suggesting a possible bullish reversal. The pattern is preceded by a bearish candle.

- Dark Cloud Cover: A two-candle pattern in which a bearish candle opens above the first candle’s high and closes below it, and a bullish candle follows.

- Tweezer Tops: A two-candle pattern where two consecutive candles have equal highs, signaling a potential reversal at the top.

- Tweezer Bottoms: A two-candle pattern where two consecutive candles have equal lows, indicating a potential reversal at the bottom.

3. Triple Candlestick Patterns

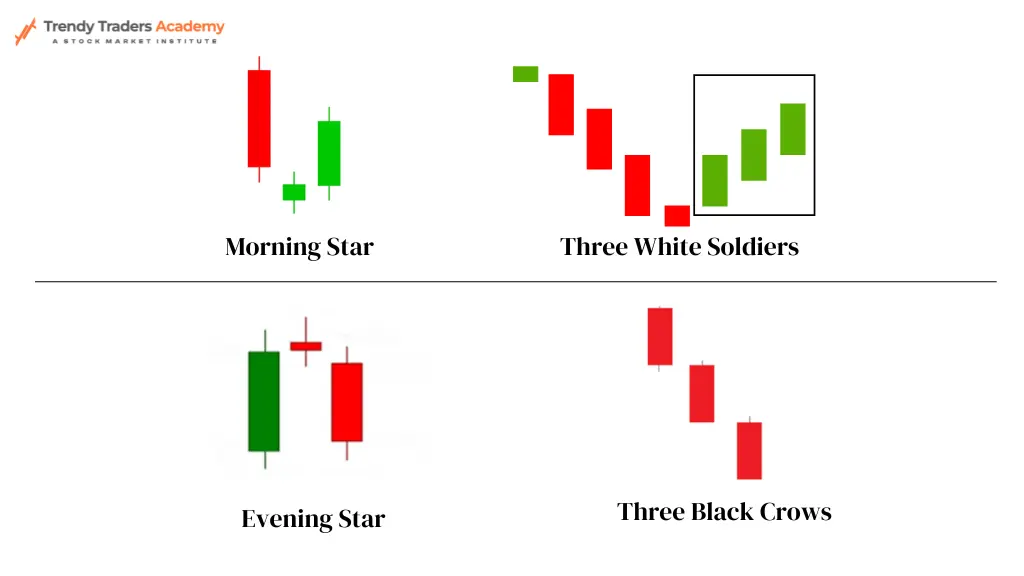

- Morning Star: A three-candle pattern consisting of a small-bodied, bearish candle (the star), a bullish candle, and a bullish candle that finishes above the first candle’s midpoint, indicating a possible bullish reversal.

- Evening Star: A three-candle pattern consisting of a bearish candle that closes below the first candle’s midpoint, suggesting a possible bearish reversal, a small-bodied candle (the star), and a bullish candle.

- Three White Soldiers: A three-candle pattern indicating a strong bullish reversal, with three successive long bullish candles with rising prices.

- Three Black Crows: A bearish reversal is strongly indicated by three consecutive long bearish candles with dropping prices, forming a three-candle pattern.

4. Complex Patterns

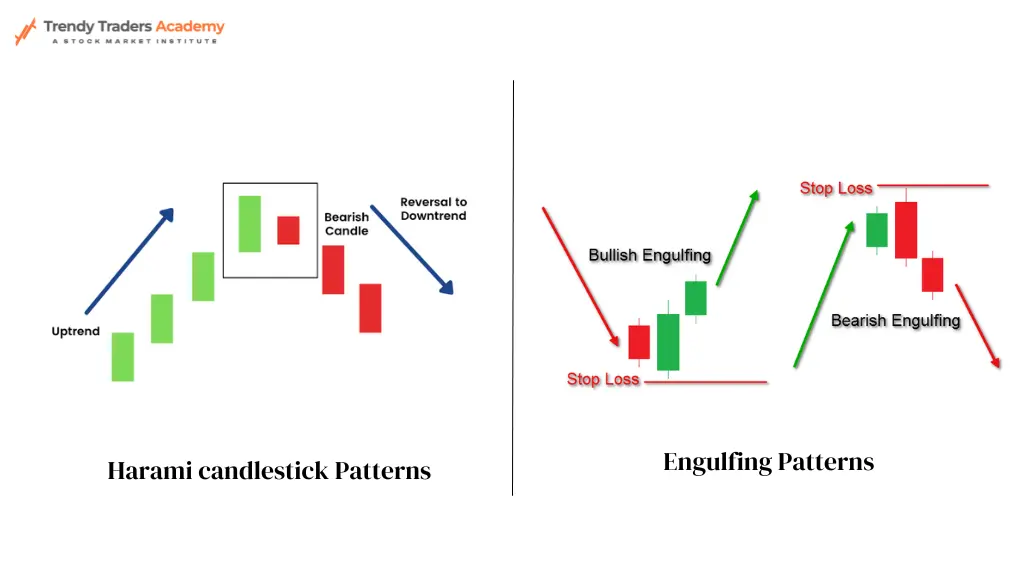

- Harami: A two-candle pattern where a large candle is followed by a smaller candle that is contained within the body of the first candle. A Bullish Harami occurs after a downtrend, and a Bearish Harami occurs after an uptrend.

- Engulfing Patterns: Similar to the double candlestick patterns but can also include more complex variations like the Three Inside Up/Down, which are used to confirm the strength of the reversal.

5. Continuation Patterns

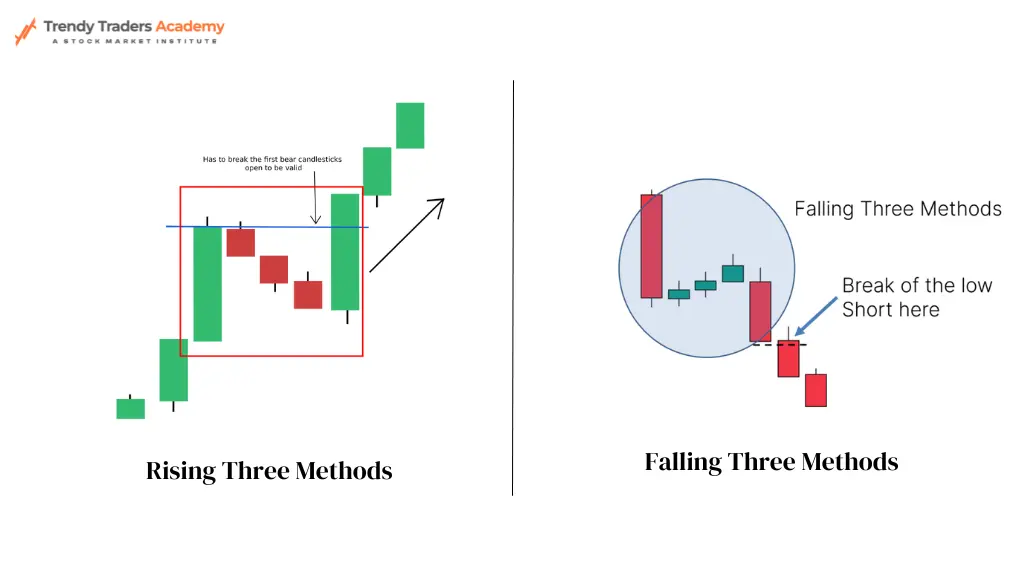

Rising Three Methods: A five-candle pattern in which there is a first bullish candle that closes above the first one, signaling a continuation of the uptrend, and three smaller candles that move within the range of the first bullish candle.

Falling Three Methods: A sequence of events consisting of five candles: an initial bearish candle, three smaller candles moving within its range, and a final bearish candle closing below the first, indicating a continuation of the downtrend.

How to Identify Bullish Candlestick Patterns

Identifying bullish candlestick patterns is necessary when trading. These patterns aid traders in recognizing possible changes in market direction. Two essential patterns to watch out for are the Hammer and the Morning Star.

What is Hammer and Its Implications

The Hammer is a powerful favorable pattern that recommends a potential bottom out there. Its body is small; its shadows are either long listed below and brief or nonexistent over. This indicates that buyers drove the cost back up after sellers tried to drive it lower. It hints at a shift in market state of mind.

A Hammer pattern indicates that you must maintain a close eye on the marketplace. It regularly shows that a bearish pattern might become favorable, which might present an opportunity to make money from the expected rise.

Recognizing the Powerful Morning Star Pattern

Another important bullish pattern that indicates a market bottom is the Morning Star.It opens up over the midpoint of the previous day and functions as three candlesticks: a long bearish one, a little center one, and a bullish one.

This pattern shows that buyers are taking over from sellers, and seeing it may signify the beginning of a new higher trend.

Acquiring ability in determining these bullish patterns can boost your trading. It provides you a competitive advantage. Acquiring knowledge of candlestick analysis can significantly improve your trading design.

Bearish Candlestick Patterns to Watch Out For

For traders, it is essential to understand both bullish and bearish candlestick patterns. Bearish trends signal potential declines in the market. Making wiser trading decisions and controlling risks are made easier with this knowledge.

One important bearish signal is the Bearish Engulfing pattern. It occurs when a large bearish candle follows a modest bullish one. The entire preceding candle is covered by this large bearish candle. It’s a good idea to consider bearish trades because it frequently indicates that the market trend may shift.

Also pay attention to the Shooting Star pattern. It has a lengthy top shadow and a small genuine body at the low end of the candlestick. This indicates that the market made a high start before pulling down, potentially indicating a top and a bearish turn.

Conclusion

In technical analysis, candlestick patterns are an essential tool that gives traders insights into possible market movements. While no single pattern promises success, recognizing typical patterns such as doji, hammer, engulfing, and shooting star can help traders improve their methods.

Recognizing these trends aids traders in predicting market movements and assisting them in making wise choices. It’s crucial to integrate candlestick analysis with other indicators and market context for a comprehensive approach to trading. Traders can improve their ability to negotiate the intricacies of financial markets by becoming proficient with these patterns.

Also Download : Trendy Traders Academy’s Free Candlestick Patterns PDF.

Check more Candlestick Patterns

Signals a possible bullish reversal after a downtrend as buyers reject lower prices. | |

Inverted Hammer Candlestick Pattern | Signals a possible bullish reversal after a downtrend as buyers reject lower prices. |

Indicates potential bullish reversal where buying pressure appears after a decline. | |

Patterns that indicate buying strength and possible upward trend reversal or continuation. | |

Patterns that signal selling pressure and a potential downward trend reversal. | |

A bullish reversal pattern where buyers regain control after a strong bearish move. | |

Confirms a strong bullish trend with three consecutive long bullish candles. | |

Warns of a possible bearish reversal after an uptrend due to selling pressure. | |

Shooting Star Candlestick Pattern | Indicates bearish reversal when price rejects higher levels after an uptrend. |

Signals a bullish reversal using a three-candle structure after a downtrend. | |

Indicates a bearish reversal at the top using a three-candle formation. | |

A bearish reversal pattern where sellers enter strongly after a bullish move. | |

Three Black Crows Pattern | Confirms strong bearish momentum with three long consecutive bearish candles. |

Doji Candlestick Pattern | Shows market indecision where buyers and sellers are equally balanced. |

Marubozu Candlestick Pattern | Represents strong momentum with no price rejection, indicating trend continuation. |

Reflects uncertainty and loss of momentum in the current trend. | |

A smoothed candlestick method that reduces market noise and helps traders clearly identify trends. |

FAQ'S

What are candlestick patterns?

Candlestick patterns show how values fluctuate in financial markets. They aid traders in identifying patterns and interpreting market sentiment. They also suggest possible price reversals.

What are the most common candlestick patterns?

Common candlestick patterns include the Hammer, Shooting Star, Doji, Bullish Engulfing, and Bearish Engulfing. These are patterns that most people are aware of.

How can I identify bullish candlestick patterns?

Bullish patterns that signal the start of long positions or market reversals include the Morning Star and Hammer. They appear to have turned from pessimistic to optimistic.

What are the key bearish candlestick patterns to watch out for?

Bearish Engulfing and Shooting Star are two bearish patterns that imply market reversals or the entry into short positions. They indicate that the sentiment has shifted from bullish to bearish.

Where can I learn more about candlestick patterns and trading strategies?

Courses on candlestick patterns, technical analysis course , and trading strategies are available at the Trendy Traders Academy. Your understanding of these crucial market tools is enhanced by expert training.

How can I apply candlestick pattern analysis to my trading approach?

To determine important patterns and their significance, use candlestick patterns. Managing risk and making judgements about entry and exit are aided by this. You can use these patterns in your trading strategy with the help of the Trendy Traders Academy.

Why are candlestick patterns important for technical analysis?

Candlestick patterns are important to technical analysis. They help traders detect market trends and levels of support and resistance. They also provide the start and end points of transactions.