Best indicators in trading: Complete guide of stock market indicators

This is the world of trading where action and decision depend on the enormous number of factors that drive the market and traders look for the needle into the haystack. To a trader/investor, technical indicators are arguably some of the most important tools of trade. These are now referred to as Trading Indicators; they are just considerably sophisticated equations which are composed or derived by price, volume, and/or open interest with a view to being used as a tool or index of the future perspective of price actions.For that reason, the use of indicators can assist the trader in placing a detection to the set trends, providing for a more efficient identification of entry and exit points, not to mention the chances that risk will be controlled in the right manner.

Here, in this blog, we will review some of the trending stock market indicators that are in use and how trading strategies using these indicators work.

Top Trading Indicators

1. Moving Averages (MA)

The moving averages are in fact probably the most used and known throughout the world indicators in the course of trading and it is a very useful and renowned indicators in market. They filter prices to achieve the oscillator that allows traders determine the direction of trend.

Types of Moving Averages:

- Simple Moving Average (SMA): The SMA is fixed by adding a particular number of closing prices and then drawing a line through the mean. For instance a 50-day SMA is calculated by calculating the average of the last fifty closing prices.

- Exponential Moving Average (EMA): EMA provides more importance to the recent prices and in that way, is much sensitive to the current price movement. For shorter time periods, the EMA is the commonly used indicator for trader because it responds to price volatility quicker than the SMA.

How to Use Moving Averages:

- Trend Identification: This way when the price is located above the moving average it means that the price range is on the upward trend while low price range points to downward trend.

- Crossover Strategy: One of the most used indicators is the moving average crossover. When the shorter moving average, for example fifty-day, goes above the longer moving average such as the two hundred-day then a buy signal is generated, which is known as the ‘golden cross’. By contrast, when the shorter moving average is falling below the longer one this is a sell signal known as the ‘death cross’.

2. Relative Strength Index (RSI)

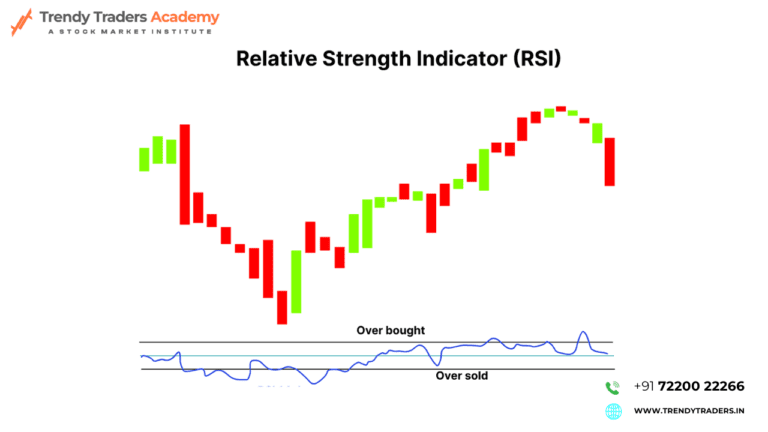

The Relative Strength Index or the RSI is an oscillator indicator, this like most indicators moves to quantify the velocity and direction of price swings. It varies between 0 and 100 and assists traders determine when a market is overbought or oversold.

How to Use RSI:

- Overbought/Oversold Levels: In context to technical analysis if RSI value is above 70 then it signals that the market might be overbought and therefore a pull back is possible. RSI below 30 indicates that the market can be oversold thus the need to buy as soon as the level is reached.

- Divergence: RSI divergence is a technical trading pattern that exists when the RSI and the asset price go in different directions. That is why this divergence can signal a reversal of the current trend. For example, when the price bar is making a higher high but RSI making lower high it can be an indication that either bullish pressure is fading and a reversal has taken place.

- RSI Swing Rejections: Traders can also use ‘swing rejections’ on the RSI, where the indicator oscillates outside of the overbought/oversold ranges, only to turn back and re-enter this range. This is considered a good indication that things will remain the same and more working families are likely to befall the same fate.

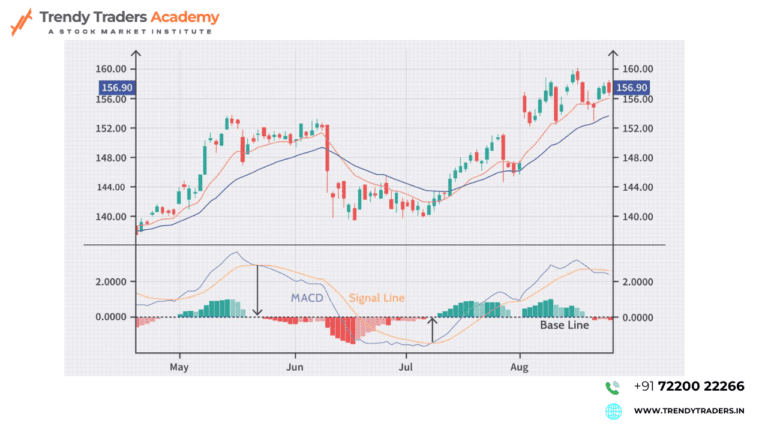

3. The MACD Aka moving average convergence divergence.

The MACD is another popular best indicators in trading of momentum and like all the indicators discussed above can be used to help the trader decide when a certain trend, strength, direction or duration has changed. It consists of two lines: The first indicator is the MACD line The second one is known as the signal line.

How to Use MACD:

- Crossover Strategy:When the MACD line crosses above the signal line, it generates a buy signal, and when it crosses below, it generates a sell signal.

- Divergence: Also similar to RSI one can use MACD in order to identify dives that show reversing patterns. If price makes new highs and MACD do not do the same, it indicates that the bulls are losing their momentum.

- Histogram: The MACD histogram is another one which actually depicts the graph between MACD line and the signal line. A larger histogram means that a certain trend is still escalating while a small histogram means that the certain trend is decelerating.

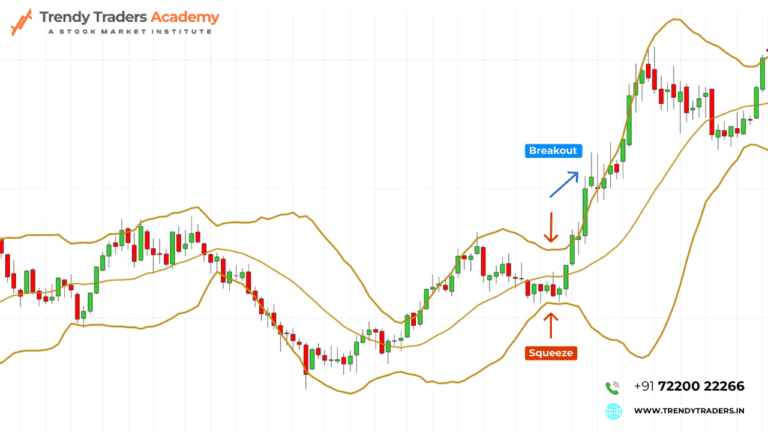

4. Bollinger Bands

They are up a moving average and volatility bands drawn below and above it. The space between the bands is derived from the standard deviation of price fluctuations, and therefore flexible to investor risk.

How to Use Bollinger Bands:

- Overbought/Oversold Conditions: This level replies that when price comes near the upper band it means that the asset is overbought and when the price comes nearer to the lower band it means that the asset is oversold.

- Breakouts: Another use of Bollinger Bands is in identifying breakouts. A squeeze, where the bands contract, and the bands making contact with the moving average imply low volatility, and normally precede a quick break out in either direction.

- Mean Reversion: As prices mean revert, once the price hits one of the bands, it is expected to go back to the middle of the band. This principle can be used by traders to cash out on any trade

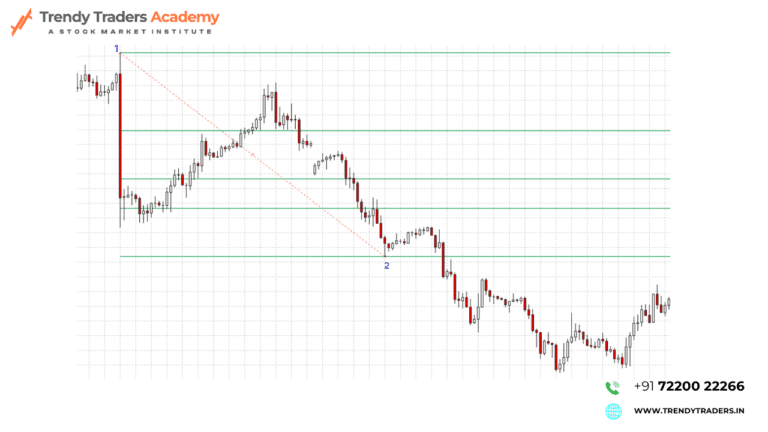

5. Fibonacci Retracement

Fibonacci retracement levels connect primary important levels with the aid of the mathematical sequence of Leonardo Fibonacci. That is why it is possible to define five key levels starting from this sequence, namely: 23.6%, 38.2%, 50%, 61.8%, and 100%. Buyers and sellers rely on these levels expecting probable support or resistance levels.

How to Use Fibonacci Retracement:

- Identifying Reversal Points: Bear traders mainly apply works of Carl Swenlin by using significant bar shapes to look for a trend reversal at the Fibonacci retracement levels once a strong price move has taken place. For instance in an uptrend the trader will wait for the price candle to go down and retest one of these levels before going long.

- Combining with Other Indicators: Trading with Fibonacci retracement levels is the most effective signal when it is accompanied by additional Moving Averages or MACD to provide entry or exit signals.

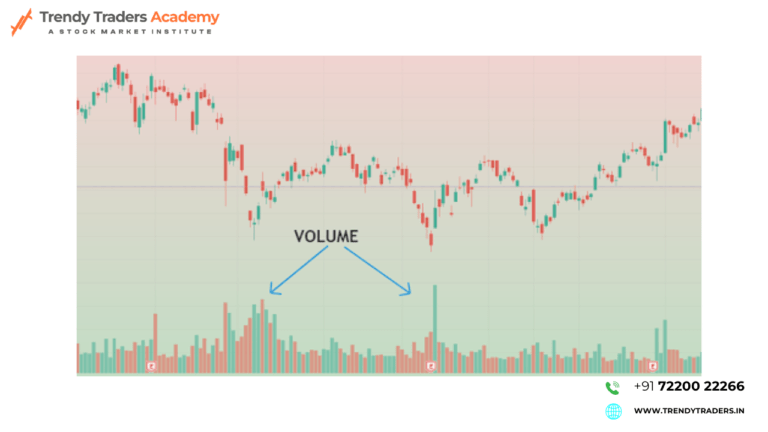

6. Volume Indicators

Volume is a major element that is used to establish the reliability of a trend and it is one of the major indicators in technical analysis. Volume bars assist a trader in gauging the level ofáhnout<|ai|>Volume bar assists a trader in determining the level of .

Common Volume Indicators:

- On-Balance Volume (OBV): OBV works by accumulating buying pressure and distributing selling pressure where volume is added on days when price rose and subtracted on days when the price fell. OBV when rising portrays a signal of buyers’ increasing aggression while declining signals show sellers as dominant.

- Volume Weighted Average Price (VWAP): Thus, VWAP goes on, it is just another trading indicator that calculates the average price of security at which it trades throughout a particular trading session depending on its volume and price. VWAP is used by traders before arriving at the price and comparing it to check if it is good or not.

How to Use Volume Indicators:

- Confirming Trends: Analyzing attractive instruments in an uptrend, an increase in trading volumes makes one expect a continuation of an uptrend, while a diminishing trading volume signals a worrying trend, such as a downtrend.

- Breakout Confirmation: In trading, volumes are used to affirm any breakout beyond some certain levels of resistance or support.

- One important characteristic a trader has to develop is patience and discipline. Achieving some kind of competence, as they do trading, requires time and hence should expect both achievements and losses.

Conclusion

There is no overarching signifier in trading which renders a certain strategy infallible, however using an aggregate of meanings the chances of arriving at truthful predictions are better. Regarding these indicators traders should understand that none of them works hundred of percent and they are best used as complementary to a trading system. Gardening it sensible to use the set indicators that have different characteristics like trend, momentum, and volatility in order to arrive at the current market conditions.

Over time, each given trader is likely to have unique pride preferences depending on the manner he/she engages in the trade, period of trade, and bearishness. The important point is to fully understand how these indicators work and how to apply them to different market circumstances. Last of all, never forget that risk management is as critical as identifying proper indicators – nothing is favorable without risk management.

Also Read : How to learn trading for beginners

FAQ'S

What are the best indicators in trading to use ?

The most important indicators in the trading field are MA, RSI, MACD and BB. All assist traders in determining trend, momentum and volatility.

How do stock market indicators help traders?

The advice of stock market indicators help one learn on the price oscillations, the trends, as well as the reversal patterns. They provide guidance on what to buy and when it is best to do it based on several past price points.

What is the role of technical analysis indicators?

There are two types of technical indicators, which play a role to predict the future price pattern by analyzing past data. These indicators enable the trader to set target, strength, floor, and ceiling within the market.

Why is the RSI indicator important in trading?

The Relative Strength Index (RSI) measures the velocity of an instrument as well as the amount of change in velocity. It is used to determine possible trends reversal overbought or oversold levels for the traders.

What is the difference between lagging and leading indicators in trading?

Indicators in Market are respondents in the market that indicate market trends and affirm past data as Lagging Indicators like Moving Averages. Relative strength indexes, as well as other leading indicators, indicate future trends in prices to enable traders to look forward to a particular change in prices.