Evening Star Pattern: Meaning, Example, Trading Chart

Understanding candlestick patterns often feels like learning a new language. Some patterns jump out on the chart because they appear so frequently. Others seem to whisper quietly, but when they do show up, they often mark turning points that traders remember for a long time. The Evening Star pattern belongs to that second group – subtle when forming, unmistakable once complete.

This pattern has been a part of market analysis long before algorithmic trading existed. Experienced traders often spot it almost instinctively because it reflects a shift in the emotional tone of the market. Prices rise confidently at first, hesitate briefly, and then reverse with a sudden wave of selling pressure. It’s this rhythm – confidence, doubt, and retreat – that gives the Evening Star candlestick pattern its reputation as one of the stronger bearish reversal indicators in technical analysis.

In this guide, we’ll walk through what the Evening Star really represents, how to read it in real market conditions, and how traders use it in their setups today. Everything is written in a simple, natural flow – the way an actual trading mentor might explain it during a workshop.

What is Evening Star Pattern?

The simplest way to think about the Evening Star candlestick pattern is this: It’s a warning sign at the end of an uptrend.

When the market has been moving up steadily and buyers appear fully in control, this pattern forms over three candles that collectively suggest the rally may have run its course.

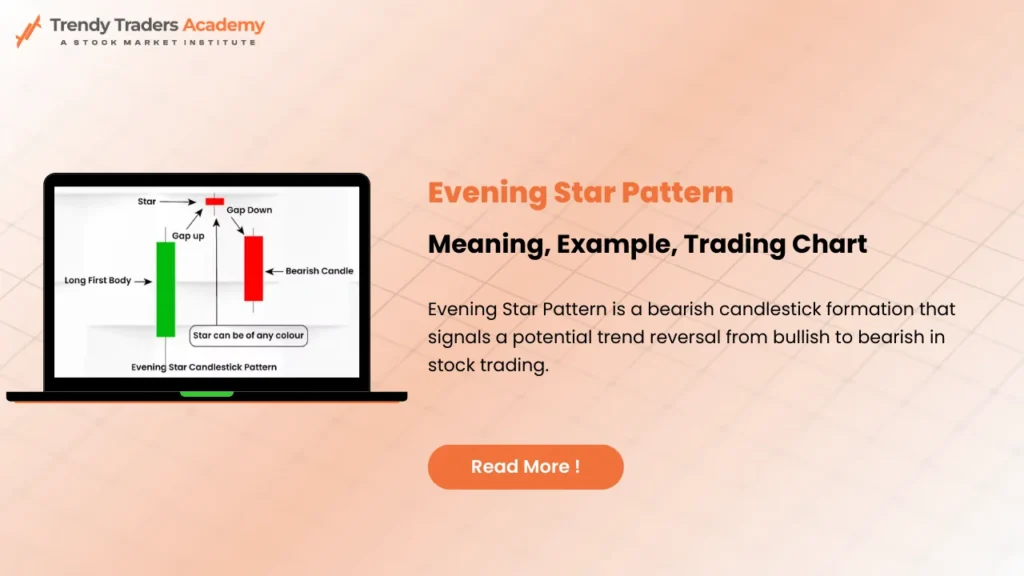

These three candles usually follow this structure:

- A strong bullish candle – price pushes up with confidence.

- A small candle – buyers slow down; indecision enters.

- A strong bearish candle – sellers step in and reverse the move.

If you were watching this unfold live, you’d see enthusiasm in the first candle, uncertainty in the second, and a decisive shift in the third. It’s not the shape alone that matters but the story these candles tell together.

Breaking Down the Three Candles

1. The Bullish Candle - Momentum at Full Speed

The first candle is often large and green. At this point, no one suspects a reversal. Buyers are hitting highs, momentum traders are excited, and everything looks like a continuation.

If you’ve ever chased a late-stage breakout, you know this feeling well.

2. The Transition Candle - Hesitation Enters the Room

The second candle is usually smaller – sometimes a spinning top, sometimes a Doji. The exact name doesn’t matter as much as the message: buyers take a breather.

Maybe the price gaps up a little, maybe not. What matters is that the upward force stalls. Those who were confident earlier now begin to question whether the rally has enough fuel left.

This is the candle that makes seasoned traders sit up and pay attention.

3. The Bearish Candle - Confirmation of the Shift

The third candle completes the pattern. It is typically a strong red candle that closes below the midpoint of the first candle.

This is where the balance of power truly changes. Buyers who were confident minutes earlier start booking profits, and fresh sellers enter the market. The uptrend bends and begins to turn.

If you’ve traded long enough, you know how quickly sentiment can flip – this candle captures that moment.

Why Does the Evening Star Pattern Work? (The Psychology Behind It)

Charts may look mechanical, but candlestick patterns come from human behavior – greed, fear, hesitation, and pressure.

The Evening Star works because:

- Buyers exhaust themselves near the top.

- Sellers find the perfect moment to strike.

- Volume often shifts to the downside.

- Those late to the rally panic when the third candle appears.

A market rarely reverses without showing signs of fatigue. The Evening Star pattern captures that fatigue beautifully.

A Simple Example You Can Visualize

- Imagine a stock that has climbed from ₹150 to ₹210 over several days. On Monday, it printed a solid bullish candle closing near ₹218. Everything looks great.

- On Tuesday, the price hardly moves. A narrow candle forms. Some traders begin to wonder if the rally is slowing.

- On Wednesday, the stock opens slightly weak and sells off sharply, closing around ₹203. The reversal is clear. The pattern is complete.

- Anyone who bought late in the rally feels trapped. Sellers suddenly take control. The trend begins to shift.

- This is the Evening Star candlestick pattern in the real world – not just theory but a story unfolding between buyers and sellers.

Key Traits of a Reliable Evening Star Candle Pattern

Not every three-candle setup qualifies as a true Evening Star. Traders usually look for these elements:

- The pattern must appear after a meaningful uptrend.

- The middle candle has to show hesitation – small body, low range, or a Doji.

- The third candle should be strong and red, ideally closing below the midpoint of the first candle.

- Volume increasing on the final candle strengthens the signal.

- It works best near resistance zones or supply areas.

These conditions help filter out false signals.

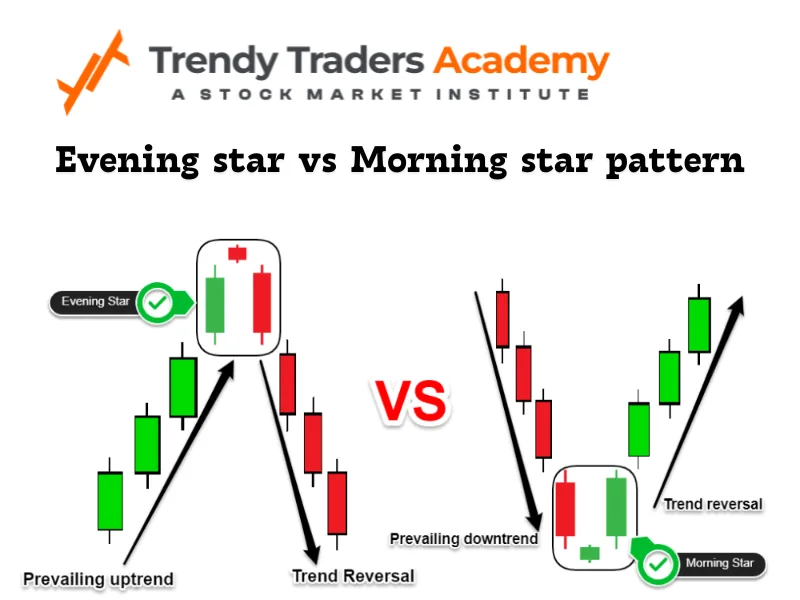

How Does the Evening Star Differ From the Morning Star?

The Evening Star marks a potential drop. The Morning Star marks a potential rise.

Here’s the simplest comparison: Knowing both helps you navigate trend shifts better.

Aspect | Evening Star | Morning Star |

Trend Context | Appears at top | Appears at bottom |

Signal Type | Bearish reversal | Bullish reversal |

Third Candle | Strong bearish | Strong bullish |

How Traders Use the Evening Star Candlestick Pattern in Real Markets?

There’s no single “correct” way to trade the Evening Star, but many traders follow a similar approach:

Step 1: Confirm the Uptrend

The pattern only matters if price has been trending upward.

Step 2: Look for the Three Candles

Bullish → Indecision → Bearish.

Step 3: Wait for Confirmation

The third candle closing below the midpoint of the first is a common rule of thumb.

Some traders wait for additional confirmation:

- A breakdown of support

- RSI divergence

- Volume spike

- Rejection from a moving average

Step 4: Entry

Most traders consider entering a short position after the third candle closes, or on a break below short-term support.

Step 5: Stop-Loss Placement

A stop-loss may be placed:

- Just above the high of the pattern

- Or above the small middle candle (tighter SL)

This makes the trade structured, not emotional.

Step 6: Target Levels

Common targets include:

- Previous support zones

- 38.2% or 61.8% Fibonacci retracement

- Demand areas

The Evening Star candle pattern is not a standalone strategy – but it is an excellent signal to combine with broader price-action and risk management.

Common Mistakes That Lead to Losses

Even experienced traders misread this pattern when they:

- Trade it without confirmation

- Ignore the broader trend

- Forget to check major resistance zones

- Place stop-loss too tight

- Enter the trade before the third candle completes

The Evening Star is powerful, but only when used with context.

A Real Trading Scenario Involving Evening Star

Take a stock like HDFC Bank during a strong rally. Prices approach a weekly resistance zone. A bullish candle forms, followed the next day by a tiny Doji near the top. The day after, the price sells off on heavy volume.

The pattern is clear. Many traders start reducing long positions, while experienced short sellers look for entries with a defined stop-loss. The reversal proceeds for several sessions.

This kind of clean setup is why the Evening Star candle pattern remains widely used across intraday, swing, and positional trading.

Advanced Confirmation Techniques

Seasoned traders rarely rely on just the pattern. They combine it with:

- RSI or MACD divergences

- Rejection from key moving averages like the 50 EMA or 200 EMA

- Volume changes

- Fibonacci retracement levels

- Supply zones identified through price action

Combining signals leads to more accurate decisions.

When You Should Avoid Trading the Pattern?

A pattern is only as strong as the structure around it. Avoid trading the Evening Star when:

- The market is sideways

- Volume is weak

- The uptrend before the pattern isn’t strong

- The third candle is too small

- A major news event is pending

Avoiding low-quality setups protects your capital more than any single winning trade.

Conclusion

One of those candlestick patterns is the Evening Star that increases in value with experience. It can appear to be a simple three candles chart at first. However, once one starts to enjoy the change of heart – when buyers get exhausted and sellers intervene in a decisive manner – the trend begins to become instinctual.

When applied properly, it will assist traders to sell long positions when appropriate, recognize reversals in good time and even plan well organized short trades. There, however, are contextual factors as well like a trend direction, support and resistance, volume and broader market behavior are all important. As you become more experienced, the Evening Star candle pattern will not be so much a diagram in the textbook, it will be a real tool of the world that makes your decision.

Also Download : Trendy Traders Academy’s Candlestick Patterns PDF.

Check more Candlestick Patterns

Bullish, bearish, neutral, continuation, and reversal patterns help traders identify market direction, momentum, and possible trend changes. | |

Signals a possible bullish reversal after a downtrend as buyers reject lower prices. | |

Inverted Hammer Candlestick Pattern | Signals a possible bullish reversal after a downtrend as buyers reject lower prices. |

Indicates potential bullish reversal where buying pressure appears after a decline. | |

Patterns that indicate buying strength and possible upward trend reversal or continuation. | |

Patterns that signal selling pressure and a potential downward trend reversal. | |

Confirms a strong bullish trend with three consecutive long bullish candles. | |

A bullish reversal pattern where buyers regain control after a strong bearish move. | |

Warns of a possible bearish reversal after an uptrend due to selling pressure. | |

Shooting Star Candlestick Pattern | Indicates bearish reversal when price rejects higher levels after an uptrend. |

Signals a bullish reversal using a three-candle structure after a downtrend. | |

A bearish reversal pattern where sellers enter strongly after a bullish move. | |

Three Black Crows Pattern | Confirms strong bearish momentum with three long consecutive bearish candles. |

Doji Candlestick Pattern | Shows market indecision where buyers and sellers are equally balanced. |

Marubozu Candlestick Pattern | Represents strong momentum with no price rejection, indicating trend continuation. |

Reflects uncertainty and loss of momentum in the current trend. | |

A smoothed candlestick method that reduces market noise and helps traders clearly identify trends. |

FAQ'S

What is Evening Star pattern?

It is a three candles bearish reversal pattern and it develops at the peak of an uptrend which points to the downside.

What is the reason the Evening Star candlestick makes sense?

It is an expression of buyer weariness and introduction of selling pressure, the natural change of market mood.

Is the Evening Star candle pattern effective?

It is predictable with supporting pointers such as volume, resistance areas, or RSI divergence.

What is the difference between the Evening Star and Morning Star?

Evening stars are indicators of bearish reversal; Morning stars are indicators of bullish reversal.

Is it possible to trade Evening Star with beginners?

Yes, but it is less risky to wait and have stop-loss orders to manage the risk.