Heikin Ashi Candlestick Pattern: Strategy, Formula & Trading Guide

Trading financial markets have become difficult for investors who must deal with price volatility along with trend instability. The Heikin Ashi candle pattern is a fundamental tool that all traders need to employ. Heikin Ashi candlesticks deliver enhanced price visualisation compared to standard candlesticks because they filter out market commotion to let traders track main trend developments.

The following guide details Heikin Ashi candlesticks before illustrating the Heikin Ashi candle calculation and showing several strong strategies that aid trading judgment.

What Is Heikin Ashi Candlestick?

The elementary definition of the Heikin Ashi candlestick begins by explaining its main components. The core of the Heikin Ashi candlestick begins with its fundamental concept. Heikin Ashi represents a technical chart system that applies an average calculation to clean up price data in an easily readable format. Heikin Ashi receives its name from Japanese because Heikin means average, and Ashi means pace.

A Heikin Ashi candlestick chart gives traders improved market trend visibility through its averaging technique that reduces extraneous price fluctuations commonly found in basic candlestick charts. The Heikin Ashi candlesticks pattern calculates price values differently than traditional candlesticks because they aim to establish a consolidated chart display.

The elementary definition of the Heikin Ashi candlestick begins by explaining its main components. The core of the Heikin Ashi candlestick begins with its fundamental concept.

How Does Heikin Ashi Differ from Traditional Candlesticks?

Before appreciating Heikin Ashi candlesticks, one must compare them to their traditional candlestick counterparts.

1. Traditional Candlestick Charts

Traditional candlesticks are the most widely used tool in technical analysis. Each candlestick represents a specific period and is formed based on:

Open price: The price at the beginning of the period.

Close price: The price at the end of the period.

High price: The highest price reached during the period.

Low price: The lowest price reached during the period.

The detailed information from traditional candlesticks becomes challenging to interpret because high volatility adds visual clutter to their complex charts.

2. Heikin Ashi Candlestick Charts

Heikin Ashi candlesticks apply averaging techniques to the price data, simplifying identifying market trends in the chart. The calculated price evaluation method enables stable market charts by drawing out the dominant market direction.

Heikin Ashi candlesticks cover price data using an averaging method to study trends, while traditional candlesticks display unaltered price action.

Heikin Ashi vs. Traditional Candlesticks

Heikin Ashi is a modified kind of candlestick that differs from the traditional one in the method of its calculation.

Candlesticks depict the occurrence of opening, maximum, minimum and closing prices for each period without enlargement, but the prices given are in raw form and can be confusing, especially in a volatile market.

Heikin Ashi candlesticks calculate their open and close based on averages, offering a clearer view of ongoing trends while sacrificing precision.

For example:

Bullish Heikin Ashi bears no lower part of the candle, implying that the bulls are very strong.

A bearish Heikin Ashi candle has a little or no upper candlewick to imply a strong downtrend.

The Heikin Ashi Candle Formula

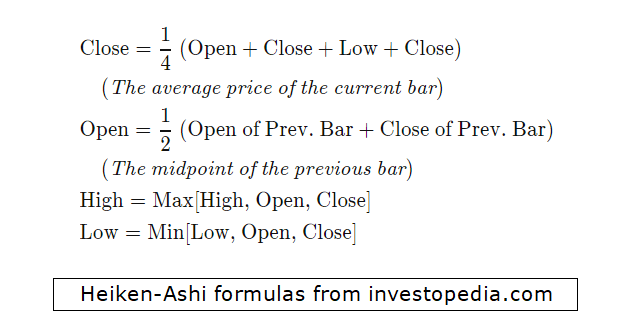

The computation algorithm for forming Heikin Ashi candlesticks stands out as it defines the approach to chart formation. To create Heikin Ashi candles, you need to apply a special averaging technique to open, close and high and low price values. Here’s how it works:

- Close = (Open + High + Low + Close) ÷ 4 The average price of the session.

- Open = (Previous Candle Open + Previous Candle Close) ÷ 2 The midpoint of the prior Heikin Ashi candle.

- High = Max(High, Current Candle Open, Current Candle Close) The highest point among the period’s data.

- Low = Min(Low, Current Candle Open, Current Candle Close) The lowest point among the period’s data.

The Heikin Ashi candle formula creates smooth candles through value averaging, simplifying trend observation and minimising market distractions.

Benefits of Using Heikin Ashi Candlesticks

Traders now choose Heikin Ashi candlesticks for their charts because they find them beneficial in trading analysis.

- Simplified Trend Analysis: Visual trend identification becomes easier through Heikin Ashi charts, which indicate both bearish and bullish and neutral market behaviours. The simplified display of Heikin Ashi candles works best for starter traders who avoid complex candlestick readings.

- Reduced Market Noise: Analysis of charts becomes challenging since market noise contains small fluctuations together with price reversals. These clusters of market movements become obsolete when using Heikin Ashi candlesticks because traders gain insight into essential trading elements.

- Improved Decision-Making: The smoothed appearance of Heikin Ashi charts protects traders against bad signals by demonstrating reliable data for making decisions.

- Visual Clarity: The organised structure of Heikin Ashi candlestick patterns creates charts that people find both pleasant to the eyes and simple to understand.

How to Read Heikin Ashi Candlesticks

Knowledge of Heikin Ashi candlestick interpretation is essential for traders using this tool since effective trading relies on it. Here’s a simple guide:

- Bullish Candles: Bullish Heikin Ashi candles typically have no lower wick or a small one. They indicate strong upward momentum and are a sign of a robust uptrend.

- Bearish Candles: Bearish Heikin Ashi candles often have no upper wick or a very small one, signalling strong downward momentum and the continuation of a downtrend.

- Indecision Candles: Candles with small bodies and both upper and lower wicks suggest market indecision or consolidation. These are often seen during periods of low volatility or before a major breakout.

Heikin Ashi Candle Strategy: Practical Approaches

Incorporating Heikin Ashi into your trading strategy can yield significant benefits. Here are some effective Heikin Ashi candle strategies:

1. Trend Following: Trend identification becomes easier by looking at clusters of either bullish or bearish candles.

The trader should enter purchases during bullish trends but sell during bearish trends.

A trader should exit during candle formations of indecision or reversal patterns.

2. Reversal Trading: The Heikin Ashi candlestick indicator allows traders to identify trading opportunities by observing changes in the candlestick formation patterns.

A bearish Heikin Ashi candle that arises after a sequence of bullish candles signifies a potential change toward market downside.

When positive Heikin Ashi signals appear after multiple negative candles it demonstrates potential upward trend change.

3. Breakout Strategy: Combine Heikin Ashi candlesticks with support and resistance levels to identify breakout opportunities. For example:

When bullish Heikin Ashi candlesticks break through resistance levels it indicates potentially the beginning of an upward movement.

A bearish Heikin Ashi candle breaking through a support level usually indicates a new downtrend might develop.

Limitations of Heikin Ashi Candlestick Patterns

While Heikin Ashi candlestick patterns are highly beneficial, they do have some limitations:

Lagging Nature: Although Heikin Ashi candlesticks provide strong benefits these patterns face several constraints during usage.

Lack of Precision: The calculation method based on averages results in delayed price detection for Heikin Ashi charts.

Less Effective in Sideways Markets: The accuracy of actual open and close prices is not visible on Heikin Ashi charts because they lack precise precision. The Heikin Ashi approach delivers limited results during markets that move horizontally rather than trending upward or downward.

Conclusion

Traders who want to analyse market trends while simplifying their analysis should adopt the Heikin Ashi candlestick pattern to improve their decision-making capabilities. Mutual averaging of pricing data in Heikin Ashi candlestick charts creates superior market trend visibility for traders.

Knowledge about Heikin Ashi candlesticks combined with skill in applying the candle formula and execution of proven Heikin Ashi strategies gives traders the tools to improve their trading decisions. The Heikin Ashi chart functions well as a beneficial analysis tool for traders using multiple technical indicators and their trading strategies. Knowledge of Heikin Ashi charts benefits traders of all experience levels in advancing their trading abilities.

Also Download : Trendy Traders Academy’s Free Candlestick Patterns PDF.

Check more Candlestick Patterns

Bullish, bearish, neutral, continuation, and reversal patterns help traders identify market direction, momentum, and possible trend changes. | |

Signals a possible bullish reversal after a downtrend as buyers reject lower prices. | |

Inverted Hammer Candlestick Pattern | Signals a possible bullish reversal after a downtrend as buyers reject lower prices. |

Indicates potential bullish reversal where buying pressure appears after a decline. | |

Patterns that indicate buying strength and possible upward trend reversal or continuation. | |

Patterns that signal selling pressure and a potential downward trend reversal. | |

A bullish reversal pattern where buyers regain control after a strong bearish move. | |

Confirms a strong bullish trend with three consecutive long bullish candles. | |

Warns of a possible bearish reversal after an uptrend due to selling pressure. | |

Shooting Star Candlestick Pattern | Indicates bearish reversal when price rejects higher levels after an uptrend. |

Signals a bullish reversal using a three-candle structure after a downtrend. | |

Indicates a bearish reversal at the top using a three-candle formation. | |

A bearish reversal pattern where sellers enter strongly after a bullish move. | |

Three Black Crows Pattern | Confirms strong bearish momentum with three long consecutive bearish candles. |

Doji Candlestick Pattern | Shows market indecision where buyers and sellers are equally balanced. |

Marubozu Candlestick Pattern | Represents strong momentum with no price rejection, indicating trend continuation. |

Reflects uncertainty and loss of momentum in the current trend. |

FAQ'S

What is Heikin Ashi candlestick?

Heikin Ashi candlestick is a modified type of candlestick chart that uses averaged price data to create a smoother and clearer visual of market trends. It helps reduce noise and highlight the overall trend direction more effectively than traditional candlesticks.

How does the Heikin Ashi candlestick pattern work?

The Heikin Ashi candlestick pattern works by using average values of open, close, high, and low prices to form candles. This pattern filters out market noise and provides clearer trend signals, making it easier for traders to identify reversals and continuations.

What is the formula for Heikin Ashi candle?

The Heikin Ashi candle formula is as follows:

- Close = (Open + High + Low + Close) / 4

- Open = (Previous Heikin Ashi Open + Previous Heikin Ashi Close) / 2

- High = Maximum of High, Heikin Ashi Open, or Heikin Ashi Close

- Low = Minimum of Low, Heikin Ashi Open, or Heikin Ashi Close

How are Heikin Ashi candlesticks different from traditional candlesticks?

Heikin Ashi candlesticks average out price data to create smoother trends, whereas traditional candlesticks show raw price movements. Heikin Ashi helps reduce false signals and provides a better view of trend strength and direction.

What is a good Heikin Ashi candle strategy for trading?

A common Heikin Ashi candle strategy involves:

- Entering long trades when green candles form with no lower wicks (strong uptrend).

- Exiting or shorting when red candles form with no upper wicks (strong downtrend).

- Combine with indicators like RSI or MACD for confirmation.

Can Heikin Ashi candlesticks be used for intraday trading?

Yes, Heikin Ashi candlesticks are suitable for all timeframes, including intraday trading. They help traders identify clear trends, avoid choppy price action, and reduce emotional decision-making.