Candlestick patterns: How many Candlestick patterns are there ?

Candlestick pattern is one of the most conventional indicators used to interpret the conditions of the market as of a certain time and in the future. These statistics were developed over 300 years ago in the Japanese rice trade and even now they can be used today and new types such as stocks forex and the newest digital type such as bitcoins.

Candlestick charts give a clear picture on price direction in any given time frame. Such a facility provides the ‘today’s candle’, which represents the candle of a given financial instrument for a specified period of time, selected from the four parameters of open, high, low, close. Longers employ candlestick patterns to predict the short and medium trends of the price data.

Let us in this guide acquaint ourselves with essential patterns of candlestick, understand their meaning and even better on how you can apply them in trading.

What is candlestick pattern ?

These patterns are made by the formation of one or two or even more than that candlesticks. Every candlestick is composed of a body together with the wicks, referred to as shadows. The body depicts the distance between the opening and the closing prices and the wicks represent the highest and the lowest prices of the current session.

Bullish Candlestick: If the close price is more than the open price it shows buying pressure and is represented as a green or white candle.

Bearish Candlestick: If it is below the opening, then it indicates selling pressure and the colors used mostly are red or black.

In general the formations can be established as single candle formation, double or multiple formation. They inform a trader whether there is a likely to be reversal or whether the situation will persist and are most often called bullish or bearish patterns depending on the projected course of price.

Top 15 types of candlestick patterns

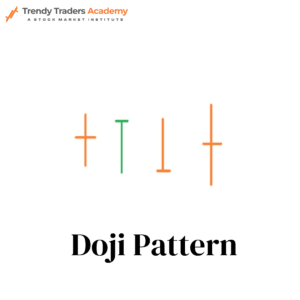

1. Doji

The Doji can be formed when the open and close price practically are within the range of the candlestick’s thin or non-existent body. The Doji shows that there is market uncertainty as both bulls and bears do not control the market.

There are three types of Doji :

- Standard Doji: A small mass with long lights indicating confusion.

- Gravestone Doji: These two are the nearest to the low of the day: an uptrend followed by a bearish reversal.

- Dragonfly Doji: The first and last digit of a price is the highest in the day which indicate a bullish signal after the formation of a downPrice bar.

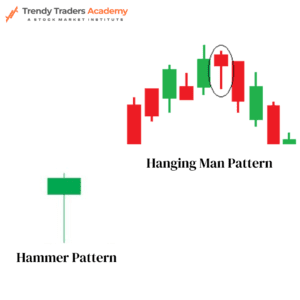

2. Hammer and Hanging Man

The Hammer and Hanging Man look identical but occur in different contexts:

- Hammer: Shown in a bearish trend indicating a small upper shadow on top of a tall lower shadow. This means that even while the sellers were in control, the buyers bought their way back to a higher price, a sign of reversal.

- Hanging Man: Rises in the chart, looks like Hammer but stands for a bearish reversal. But it shows that selling pressure is gradually starting to seep in even when bullish pressure is there.

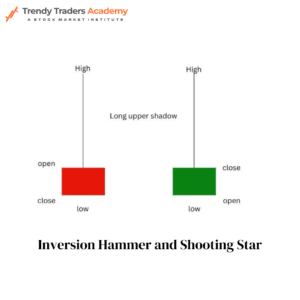

3. Inversion Hammer and Shooting Star

Similar to the Hammer and Hanging Man, these patterns reflect market reversals:

- Inverted Hammer: Is found to be in a bearish trend and is characterized by a small candlebox with a long upper shadow. This shows that buyers attempted to drive the price upward thus implying a test of Bulls Reversal.

- Shooting Star: Looks like an uptrend and is similar to an inverted hammer but informs that the bears took over the bulls.

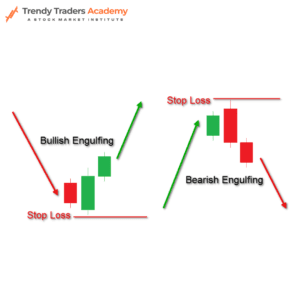

4. Bullish Engulfing Pattern

This pattern consists of two candles: where a small bearish candle is traded immediately by a relatively bigger bullish candle. The large candle, called bullish candle or buying candle regarded as, engulfs the bearish candle or selling candle, signifies the change of hands from sellers to buyers. It emerges mostly during the latest phase of bearish patterns, suggesting a bullish turn on the chart.

5 . Bearish Engulfing Pattern

The opposite of the above pattern is given when a small bullish candle is followed by a large bearish candle. The larger candle covers the smaller one suggesting the bearish reversal after an up move and relatively higher selling pressure.

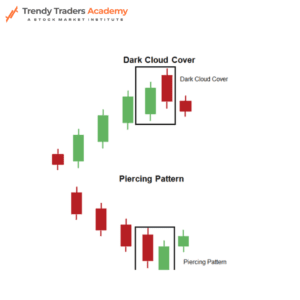

6. Piercing Pattern

Piercing pattern is an upside breakout pattern that occurs when an associated downtrend is broken. The first candle is bearish and the second is small and opens lower than the first day but close above the middle of the first candle which indicates buying pressure on lower levels.

7. Dark Cloud Cover

This bearish reversal pattern develops after an uptrend has taken place. The first is a bullish candle, then comes damaged bullish sentiment with a further bearish candle in which the opening price is higher than the preceding candle’s real body but closes below the midpoint of the first candle.

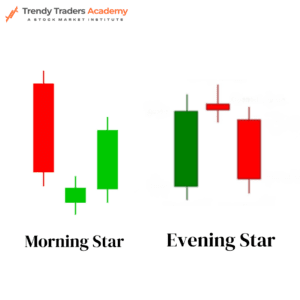

8. Morning Star

The Morning Star is a bullish reversal pattern formed by three candles:

- First Candle: This shows a very bearish looking candle, in a overall bearish trend.

- Second Candle: A small body delegation the market in a state of uncertainty that is, either bullish or bearish.

- Third Candle: A huge bullish candle that extends far up in the direction of the Y axis from the first candle and its upper wick illumination marks the end of sellers’ dominance.

It is always an indication that a downtrend has come to an end while an uptrend is about to begin.

9. Evening Star

The Evening Star is the bearish counterpart of the Morning Star, forming at the top of an uptrend:

- First Candle: A large bullish candle here also enjoying the forward momentum.

- Second Candle: A small body that represented one side of a conflict, disagreeing with the other bigger body.

- Third Candle: A fully black candle that would be out of the upper wick of an ‘upper Wick bullish candle,’ the complete opposite of what one would expect showing the bulls are in control of price action.

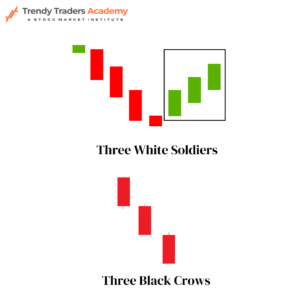

10. Three White Soldiers

Three White Soldiers is a very solid bullish reversal pattern where the last three candles are long bullish candles with very small upper wicks. The candles open further inside the body of the prior candle and also their tops are closing at a higher level which indicates buying. On most occasions it is used to highlight a shift from a bearish trend to a bullish one.

11. Three Black Crows

The counterpart of the Three White Soldiers, the Three Black Crows pattern is formed by three long bearish candles. Every candle rises within the prior candle and weakens this lower, indicating a change from bulls to bears and beginning of the down move.

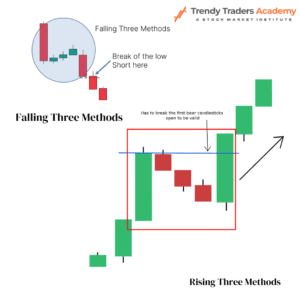

12. Rising Three Methods

It appears during an upward trend and shows that the upward movement is expected to go on. Large bullish candle is formed followed by three micro bearish or neutral candles completely contained within the range of the first large bullish one and then a bullish candle again close above the close of the first large bullish candle.

13. Falling Three Methods

Similar to the Rising Three Methods – Bearish is formed in a downtrend of the market. This pattern consists of a big black candle, and then three smaller white or doji candles contained within the big black candle’s range, and finally a big black candle that closes below the lower wick of the first candle. This pattern agrees with the downtrend and supports the resultant trend indicator.

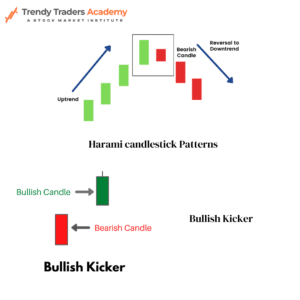

14. Bullish Harami

This is because reading of the bullish candlestick pattern gives the impression that a bull run is about to happen. The Bullish Kicker Candlestick pattern is one of the powerful indicators perceived in the bullish market where a change from a bearish market to bullish market is identified. The long lower shadow indicates that there was a great selling pressure in the market but this was countered by an even greater buying pressure as the price opened above the previous day’s close and as a result went up. Image: To know what the pattern looks like.

15. Bullish Kicker

The Bullish Harami form a price chart that helps show price oscillation within the ongoing bear market. The Bullish Harami candlestick pattern is in fact made of two candles where the first is a big bearish cand and the second is a small bullish cand. The entire body of here lies thus, is contained with the body of the prior bearish candlestick. The Bullish Harami is what investors and traders see as a small-bodied bullish candlestick reversal of the bearish trend.

Conclusion

Candlestick patterns are strong patterns used for carrying the sentiment of the market and thus enabling a trader to forecast the impending price fluctuation. Such patterns will enable technical analysts to understand patterns that are likely to enhance their technical analysis skills when trading.

As everybody knows, there is no winning-all-sure strategy anywhere. Trading is marred with risk and thus involves probabilities, this means that mastering candlestick patterns alone will not sustain any smart trader in the long run, but instead they should be used hand in hand with other technical tools, analysis and responsible risk management strategies.

Also Download : Trendy Traders Academy’s Free Candlestick Patterns PDF.

Check more Candlestick Patterns

Signals a possible bullish reversal after a downtrend as buyers reject lower prices. | |

Inverted Hammer Candlestick Pattern | Signals a possible bullish reversal after a downtrend as buyers reject lower prices. |

Indicates potential bullish reversal where buying pressure appears after a decline. | |

Patterns that indicate buying strength and possible upward trend reversal or continuation. | |

Patterns that signal selling pressure and a potential downward trend reversal. | |

A bullish reversal pattern where buyers regain control after a strong bearish move. | |

Confirms a strong bullish trend with three consecutive long bullish candles. | |

Warns of a possible bearish reversal after an uptrend due to selling pressure. | |

Shooting Star Candlestick Pattern | Indicates bearish reversal when price rejects higher levels after an uptrend. |

Signals a bullish reversal using a three-candle structure after a downtrend. | |

Indicates a bearish reversal at the top using a three-candle formation. | |

A bearish reversal pattern where sellers enter strongly after a bullish move. | |

Three Black Crows Pattern | Confirms strong bearish momentum with three long consecutive bearish candles. |

Doji Candlestick Pattern | Shows market indecision where buyers and sellers are equally balanced. |

Marubozu Candlestick Pattern | Represents strong momentum with no price rejection, indicating trend continuation. |

Reflects uncertainty and loss of momentum in the current trend. | |

A smoothed candlestick method that reduces market noise and helps traders clearly identify trends. |

FAQ'S

How many candlestick patterns are there?

how many candlestick patterns are there : There are majorly 42 types of candlestick patterns and 15 are important.

What is a Bullish Pattern?

Patterns indicating upside momentum are bullish patterns.There are many bullish patterns available but it depends upon the target and formation in the chart.

What is a Bearish Pattern?

Patterns Indicating downward momentum are bearish patterns. There are many according to the chart movement or market movement.

Do patterns guarantee the market movement?

No pattern guarantees market movement. It is just an Indicator. It is recommended to take confirmation before any entry.