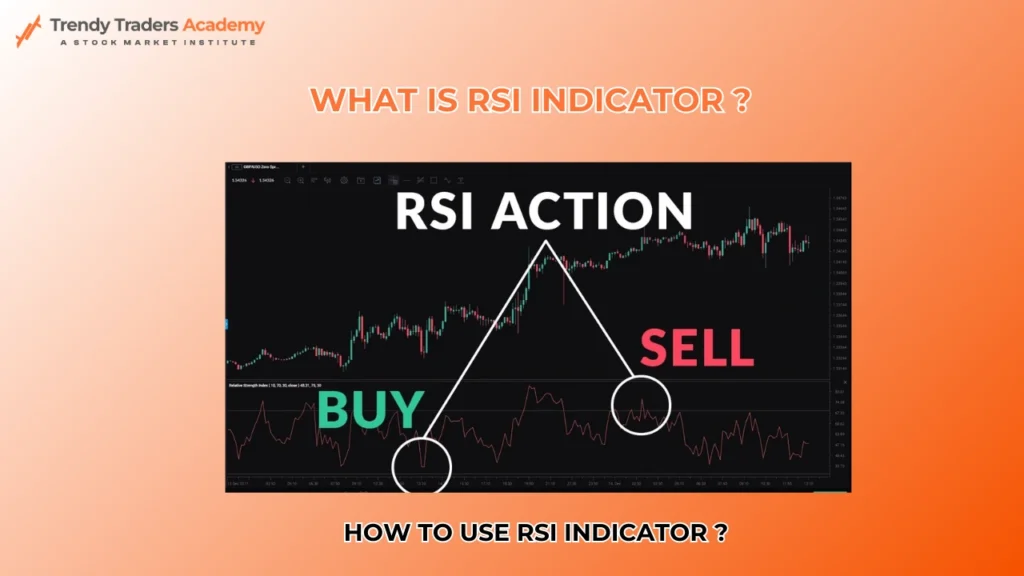

How to use RSI Indicator ? What is RSI Indicator ?

Relative Strength Index serves as a primary indicator for technical market analysis that remains extensively employed by traders and investors throughout financial markets. J. Welles Wilder built the Relative Strength Index (RSI) as a tool to measure price movement dynamics and speed for identifying when assets become either overbought or oversold since its 1978 introduction. RSI serves as a fundamental instrument available to technical analysts who seek to uncover price shift patterns and market trend retention data alongside directional performance assessment.

This article extensively investigates RSI fundamentals alongside its execution mechanics and trading applications for decision-making clarity. At the conclusion you will grasp both the RSI fundamentals as well as its real-world applications within trading methods.

What Is RSI Indicator ?

A momentum oscillator called RSI measures values between 0 and 100. The main purpose of this indicator stands as determining market conditions which fall outside of appropriate value ranges.

Overbought: The asset shows signs of potential price drop and four reinforcement when its RSI value goes beyond seventy.

Oversold: An asset currently demonstrating oversold conditions becomes evident by RSI readings that fall beneath 30 points.

Trader success in all financial sectors including stocks, forex and cryptocurrencies relies on the indispensable RSI which tracks price momentum and strength even though it operates on a basic concept.

How is the RSI Indicator Calculated ?

The formula for RSI is as follows :

RSI=100–100/1+RS

Where:

RS (Relative Strength) = Average Gain over a specific period / Average Loss over the same period.

Traders can select their desired time period for RSI calculations but the default period match setting is 14 days. Here’s how the calculation works in steps:

Determine Gains and Losses:

Subtract the current price value from its previous price value for every period of measurements.

Document all positive changes as gains together with all negative changes as losses.

Calculate Average Gains and Losses:

Monitoring the combined collection of gains and recorded losses produces an average value during the period. To calculate the 14-period RSI the average gain becomes the sum of gains divided by 14 and the average loss means dividing the sum of losses by 14.

Compute the Relative Strength (RS):

The average gain is divided by the average loss to obtain the relative strength.

Apply the RSI Formula:

You can obtain a value between 0 and 100 by entering the RS result into the RSI mathematical model.

Plots of RSI values present market momentum through line graphs based on the computed result.

Interpreting the RSI : Key Levels and Signals

Through its diverse features the RSI allows traders to develop multiple methods for analyzing market situations. The most common signals include:

Overbought and Oversold Levels

Overbought (Above 70): This data shows that the market asset holds excessive value making it vulnerable to an upcoming pullback or correction.

Oversold (Below 30): Companies should raise their stock price in a near future because their assets have demonstrated potential undervaluation.

Divergences

Bullish Divergence: When the Relative Strength Index develops higher minute lows accompanied by decreasing price lows it indicates this condition. The sign shows decreasing selling power with upward market potential.

Bearish Divergence: When the Relative Strength Index draws lower highs but price creates higher highs this indicates that trend strength is weakening. The data indicates that purchasing power moderation might cause an upwards price shift.

Midline Crossover

The RSI’s midline is at 50. An RSI reading above 50 confirms upward market direction yet a reading under 50 signals downward market forces.

Failure Swings

When RSI Indicator moves beyond a crucial threshold of 70 and returns to roll back but stops short of achieving this level a failure swing occurs. This often signals a reversal.

RSI Indicator Settings : Customization for Different Strategies

While the default 14-period RSI Indicator is the most commonly used setting, traders can adjust the period to suit their strategy:

Short-Term Traders: Instruments with shorter RSI periods of 7 or 9 exhibit better price movement detection. This time-based configuration offers value to day trading professionals who need to observe fast market indicators.

Long-Term Traders: To view broader market trends instead of RSI volatility use RSI periods which extend to 20 or 30.

True-overbought and oversold thresholds modified at 80 by 20 help traders eliminate artificial signals in active price movements.

How to Use RSI Indicator Practical Applications

After learning what is RSI Indicator, Let’s see how to use RSI Indicator and its practical application.

The RSI indicator enables traders to develop multiple trading strategies which lead to better decision-making in markets. Here are some common approaches:

Reversal Trading

A trading signal occurs when the RSI indicator moves above level 70 or falls below level 30.

Traders should integrate RSI readings with specific patterns (candlestick patterns or support/resistance levels) to verify trading signals.

Trend Confirmation

Verify trend strength through RSI indicator analysis. For example:

During a powerful upward trend the Relative Strength Index (RSI) typically remains above the 50 level.

During times of sustained market decline the Relative Strength Index maintains positions beneath the 50 threshold.

Divergence Trading

You should use divergent RSI movements as indicators to determine the best moments to trade in or out of positions. Market participants should take buying opportunities during bullish divergences yet consider selling positions when bearish divergences appear.

Breakout Trading

The RSI gains power to validate breakouts through its use in combination with price movement analysis. An upward price continuation receives additional validation when the RSI crosses above level 50 during a price breakout event.

Strengths of the RSI Indicator

The RSI Indicator is favored by traders for several reasons:

Ease of Use: New traders find the RSI Indicator both simple to use and simple to understand.

Versatility: The RSI indicator functions effectively within all financial markets such as stocks and forex and commodities and cryptocurrencies.

Customizability: Through adjustable settings traders can optimize their trading approach for specific market conditions.

Early Warnings: The RSI provides mailed warnings which help traders predict possible trend changes and duration foretells.

Limitations of the RSI Indicator

Like any indicator, the RSI Indicator is not without its limitations:

False Signals: During times of market volatility the RSI sometimes provides incorrect signals when prices reach overbought or oversold levels.

Lagging Nature: The RSI operates using past data while showing a time delay when analyzing actual price changes.

Ineffectiveness in Strong Trends: A strong trend will cause the RSI to sit in oversold or overbought territory longer than usual making early trading decisions risky.

Traders boost the accuracy of their RSI strategy by adding additional technical tools including moving averages and Bollinger Bands or MACD to their analysis.

How to Use RSI Indicator Effectively ?

To get the most out of the RSI, consider the following tips:

Combine with Other Indicators: Appeal to additional trading instruments with RSI to validate all trading signs while decreasing false order risks.

Analyze Market Context: Tour analysis must clarify if market patterns display trending actions or establish range activities. The RSI achieves its best results when applied to ranging trading environments yet traders need to make adjustments when dealing with trending market conditions.

Test Custom Settings: Find the best system for your trading strategy by testing different RSI periods alongside levels.

Use Higher Time Frames: Insightful signals using the RSI emerge best from studying it across daily and weekly chart periods in conjunction with shorter time intervals.

Conclusion

As a versatile and effective technical indicator the Relative Strength Index (RSI) provides important market momentum information to traders and investors. The RSI provides market momentum analysis alongside reversal signals which helps users develop more knowledgeable trading decisions. Technical indicators must be combined with complete analytical resources along with structured trading methods to achieve their optimum performance.

Novice traders seeking an operational indicator with their basic toolkit and demanding investors looking for deal hWnd confirmation through the RSI will find it helpful. Learning how to use RSI properly brings major benefits to your market navigation resulting in better trading performance.

FAQ'S

The RSI (Relative Strength Index) is a popular technical analysis tool that measures the speed and change of price movements. It ranges from 0 to 100, helping traders identify overbought or oversold conditions in the market.

RSI calculates the average gain and loss over a specific period, typically 14 days. A reading above 70 indicates overbought conditions, while a reading below 30 signals oversold conditions.

Buy Signal: When the RSI dips below 30 and starts moving upward, it may signal a buying opportunity.

Sell Signal: When the RSI rises above 70 and begins to drop, it may indicate a good time to sell.

While RSI is a powerful tool, it is best used with other indicators like Moving Averages or MACD to confirm trends and reduce false signals.

- Relying solely on RSI without confirmation from other indicators.

- Ignoring the broader market trend, as RSI signals work better in ranging markets than in strong trends.

- Misinterpreting divergence signals without additional analysis.