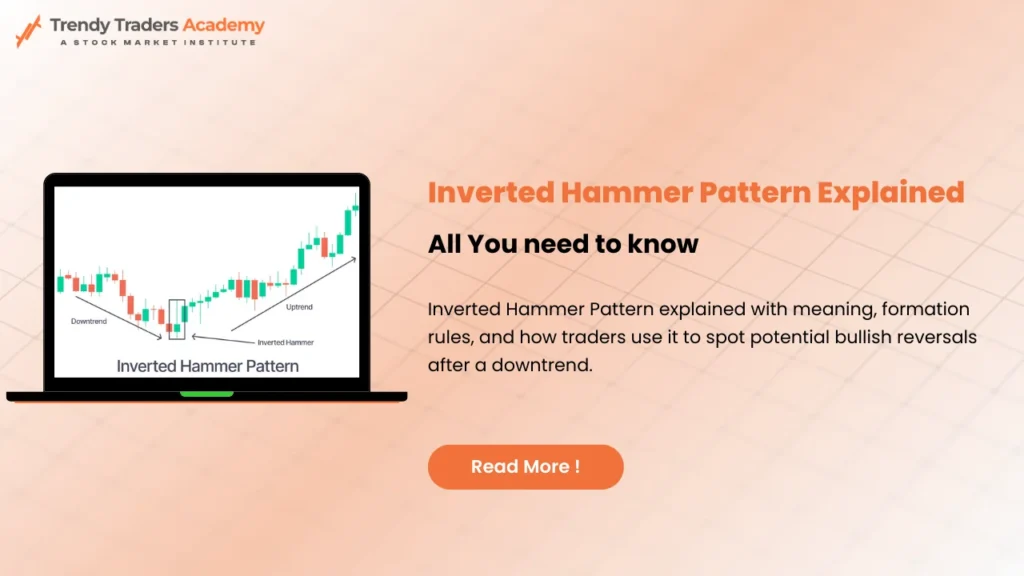

Inverted Hammer Pattern Explained: All You need to know

In the stock market, reversals rarely announce themselves loudly. More often, they leave subtle clues on the chart. One such indicator is the inverted hammer candlestick pattern – an easy sacrifice to lose, but potent when interpreted effectively.

Fear tends to prevail after a long period of decline. Buyers hesitate and sellers sound extremely confident. Then all at once, a candle is created which narrates another tale. Prices start increasing in the session demonstrating that buyers are ultimately coming in. They may not actually win the day, but they are there. It is the upside-down hammer candle.

To the Indian traders, regardless of whether he is selling stocks, trading indices or intraday arrangements, the inverted hammer may serve as an early warning that the selling pressure is diminishing. It does not necessarily lead to the reversal, yet it frequently becomes the initial change of mood.

The inverted hammer pattern has been simplified in this blog to explain its best application, the examples found in the Indian market and how it is applied responsibly by traders whether in discretionary or systematic trading.

What is the Inverted Hammer Candlestick Pattern?

One type of bullish reversal with one candle is the inverted hammer and it also tends to occur in a downward trend.

It is not as much about its size, but its message: vendors are losing their grip and buyers are beginning to stretch their boundaries with increased prices.

Structure of an Inverted Hammer Candle

An inverted hammer candle has:

- A small real body near the lower end of the candle

- A long upper shadow (at least twice the body)

- Little or no lower shadow

This structure shows that prices moved significantly higher during the session but closed near the opening level.

Inverted Hammer: The Psychology Behind the Pattern

Candlestick patterns are visual representations of trader behaviour. The inverted hammer reflects a subtle but important shift.

Here’s what usually happens:

- The market opens weak after a downtrend

- Sellers try to push prices lower

- Buyers step in and push prices higher

- Sellers manage to pull prices back near the open

Even though buyers don’t completely dominate, their appearance after a downtrend is significant. It shows demand at lower levels.

Inverted Hammer in a Downtrend

The inverted hammer is most meaningful in a downtrend.

Why?

- Sellers are already in control

- Sentiment is negative

- Any buying interest becomes important

Inverted hammer is one of the signs that downside momentum is decreasing when it follows some red candles.

Uptrend Inverted Hammer: Is it relevant?

Many traders ask about inverted hammer in uptrend.

In an uptrend:

- The pattern loses its bullish meaning

- It may act as a pause or consolidation candle

- It should not be treated as a reversal signal

Context defines the pattern. Without a downtrend, the inverted hammer has limited value.

Inverted Hammer vs Shooting Star

These two candles look similar but mean opposite things.

Feature | Inverted Hammer | Shooting Star |

Prior trend | Downtrend | Uptrend |

Signal | Bullish reversal | Bearish reversal |

Market psychology | Buyers testing strength | Buyers losing strength |

Never trade these patterns without checking the trend.

What About the Inverted Red Hammer Candlestick?

The inverted red hammered candlestick arises when the candle closes a little lower than its opening.

Important points:

- Colour is less important than structure

- Long upper wick still shows buying interest

- Confirmation becomes even more critical

Both green and red inverted hammers can work, provided confirmation follows.

Confirmation: The Rule That Separates Traders from Gamblers

An inverted hammer must be confirmed.

Confirmation usually means:

- The next candle closes above the inverted hammer’s high

- Buying volume increases

- Price does not break below the inverted hammer’s low

Without confirmation, the pattern remains only a warning sign.

Indian Market Example: Stock-Level Scenario

Imagine a mid-cap stock that has fallen 20% over a month. Panic selling dominates, and sentiment is negative. One day, the stock forms an inverted hammer near a previous support zone.

The next session:

- Price opens higher

- Breaks above the inverted hammer’s high

- Closes strong

This often attracts short covering and fresh buying, leading to a relief rally.

Indian Market Example: Index Context

On indices like NIFTY or Bank NIFTY:

- Inverted hammers often appear near demand zones

- They signal temporary exhaustion of selling

- They are more reliable on daily charts

Such patterns usually lead to consolidation or short-term recovery rather than immediate trend reversal.

How Traders Use the Inverted Hammer Pattern?

Entry Strategy

- Wait for bullish confirmation

- Enter above the inverted hammer’s high

- Avoid anticipating the reversal

Patience improves probability.

Stop Loss Placement

A logical stop loss is:

- Below the low of the inverted hammer

If price breaks below that level, the pattern has failed.

Targets and Exits

Common targets include:

- Previous resistance zones

- Short-term moving averages (20 EMA / 50 EMA)

- Recent swing highs

Risk-to-reward should always be favourable.

Using the Inverted Hammer in Intraday Trading

On intraday charts:

- Works best on 15-minute and 30-minute timeframes

- More reliable near support or VWAP

- Should align with broader market structure

Intraday inverted hammers help spot short-term reversals after sharp sell-offs.

Inverted Hammer for Swing Traders

Swing traders prefer:

- Daily or weekly inverted hammers

- Patterns near major support levels

- Clear confirmation within 1–2 sessions

Weekly inverted hammers often signal medium-term bottoms or trend pauses.

Common Mistakes Traders Make

Some frequent errors include:

- Trading inverted hammers without a downtrend

- Ignoring confirmation

- Confusing it with shooting star

- Using tight stop losses inside the wick

Candlestick patterns require discipline, not guesswork.

How Reliable Is the Inverted Hammer Pattern?

No pattern is perfect.

The inverted hammer performs better when:

- The downtrend is extended

- Volume supports the reversal

- The pattern forms near support

Professional traders treat it as a probability signal, not a certainty.

Inverted Hammer in Systematic & Algo Trading

In rule-based trading, the inverted hammer can be defined using:

- Wick-to-body ratios

- Trend filters

- Volume conditions

This helps traders evaluate whether the inverted hammer adds real edge to a strategy rather than relying on visual bias.

Who Should Use the Inverted Hammer Pattern?

- Price-action traders

- Swing traders

- Intraday traders

- Systematic traders

It is especially useful for traders who prefer clear risk levels and early reversal clues.

Why Beginners Should Learn This Pattern?

The inverted hammer teaches:

- Trend awareness

- Patience and confirmation

- Risk management

- Market psychology

Even recognising it can help beginners avoid panic selling near bottoms.

Conclusion

The inverted hammer may look small, but its message is meaningful. It represents the first sign that buyers are willing to step in after a downtrend. While it doesn’t guarantee a reversal, it highlights a potential shift in sentiment that traders should not ignore.

Used correctly-with proper context, confirmation, and risk management-the inverted hammer becomes a valuable addition to any trader’s toolkit. Used carelessly, it turns into noise. The difference lies in discipline.

Markets reward those who listen closely to price action. One of them is the inverted hammer, the silent cue that can assist traders to enter at a better time and risk to a better extent when deciphered.

Also Download : Trendy Traders Academy’s Candlestick Patterns PDF.

Check more Candlestick Patterns

Bullish, bearish, neutral, continuation, and reversal patterns help traders identify market direction, momentum, and possible trend changes. | |

Signals a possible bullish reversal after a downtrend as buyers reject lower prices. | |

Indicates potential bullish reversal where buying pressure appears after a decline. | |

Patterns that indicate buying strength and possible upward trend reversal or continuation. | |

Patterns that signal selling pressure and a potential downward trend reversal. | |

A bullish reversal pattern where buyers regain control after a strong bearish move. | |

Confirms a strong bullish trend with three consecutive long bullish candles. | |

Warns of a possible bearish reversal after an uptrend due to selling pressure. | |

Indicates bearish reversal when price rejects higher levels after an uptrend. | |

Signals a bullish reversal using a three-candle structure after a downtrend. | |

Indicates a bearish reversal at the top using a three-candle formation. | |

A bearish reversal pattern where sellers enter strongly after a bullish move. | |

Three Black Crows Pattern | Confirms strong bearish momentum with three long consecutive bearish candles. |

Doji Candlestick Pattern | Shows market indecision where buyers and sellers are equally balanced. |

Marubozu Candlestick Pattern | Represents strong momentum with no price rejection, indicating trend continuation. |

Reflects uncertainty and loss of momentum in the current trend. | |

A smoothed candlestick method that reduces market noise and helps traders clearly identify trends. |

FAQ'S

What is the inverted hammer candlestick?

A reversal cancer that is bullish and follows a downtrend.

Bullish or bearish inverted hammer?

It is bullish when confirmed.

Can an inverted hammer appear in an uptrend?

Yes, but it loses reversal significance.

What confirms an inverted hammer?

A bullish candle closing above its high.

Is the inverted red hammer still valid?

Yes, colour is less important than structure.