New GST Rate List After 22 September 2025: Your Complete Guide

GST Gets a Festive Upgrade for India

On September 22, 2025, India’ Goods and Services Tax System took a major step forward. Whether one runs a small business, goes shopping for household goods, or simply wants to get a grasp of understanding their bills- getting updated on the new gst rate list will help an individual to navigate purchases, budgets and tax filing in a confident manner in the upcoming months.

This blog will dive into the new gst rates list, explain the changes that are important, and make sense of how these updated rates actually affect daily life, businesses and future savings. If one requires latest scoop on gst rates in India and the new gst tax rate structure, one is in the right place

Why Did GST Rates Change?

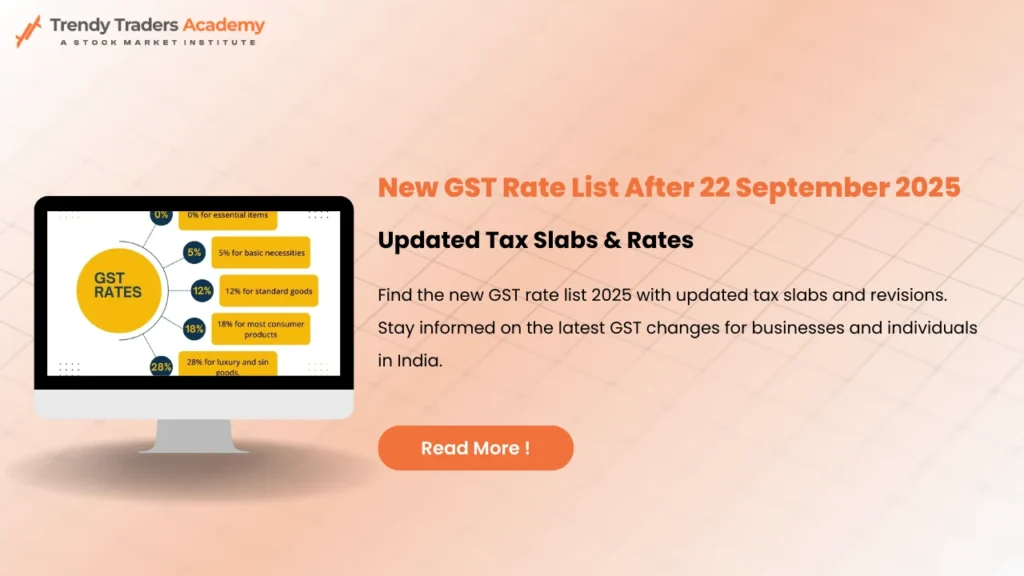

For years, GST rates in India has spread across multiple slabs—5%, 12%, 18%, and 28%. Many found the structure confusing, with huge differences from one product or service to another. After much debate, the GST Council decided to streamline the system.

The goal is simple:

- Make tax bills easier to read and predict

- Lower taxes on essentials

- Speed up refunds and compliance

- Help businesses plan and grow for the long-term

New GST Rate List: The Big Picture

Effective September 22, 2025, India’s GST regime is consolidated into three core slabs (and a nil category):

GST Rate | Category |

Nil (0%) | Exempted essentials (healthcare, education, lifesaving drugs, some food items) |

5% | Essentials that are important for daily life (foods, farm equipment, basic household products, agri goods, dairy) |

18% | Standard goods/services that most people often require (appliances, most electronics, cars, small motorcycles, processed food, apparel, footwear above ₹2,500) |

40% | Luxury & sin goods (aerated drinks, pan masala, luxury vehicles, premium consumer products) |

Most items previously at 12% and 18% have been reduced to the 5% or 18% bracket, and a select few now get the highest tax.

What Really Gets Cheaper or Costlier?

- Cheaper: Many commonly used goods (dairy, medicines, simple agri tools, basic household items, most processed foods, daily essentials).

- Costlier: Premium luxury items, sin goods (tobacco, pan masala, aerated beverages), some imports.

- Same/Steady Rates: Apparel up to ₹2,500 per piece, basic textiles, cotton quilts—all at 5%.

New GST Rates List for Major Categories (2025)

Item/Service | Previous Rate | New GST Tax Rate |

Basic groceries | 12%/18% | 5% |

Dairy products | 12% | 5% / Nil |

Medicines (life-saving) | 5%/12% | Nil |

Healthcare services | 12% | Nil/5% |

Mobile phones | 18% | 18% (unchanged) |

Refrigerators, TVs | 28% | 18% |

Small cars (<1500cc) | 28% | 18% |

Motorcycles (<350cc) | 28% | 18% |

Premium cars (>1500cc) | 28% | 40% |

Aerated waters | 18%/28% | 40% |

Pan masala, tobacco | 28%/60% | 40% (in stages) |

Note: Old highest slab of 28% now applies only on specific items pending further updates; majority move to 18% or 40%.

Step-by-Step: How Does GST Apply After September 2025?

- Each product/service now falls under Nil, 5%, 18%, or 40%.

- Check your bill/invoice for the bracket—most will be labeled by rate.

- Track updates from government GST portals for the latest changes.

- For business owners: update your invoicing/tax codes before Diwali to avoid compliance issues.

Key Benefits of New GST Rates List for Households

- Simpler invoices, fewer confusing categories.

- Cheaper day-to-day purchases—milk, snacks, farm tools, basic medicines.

- Faster refunds and simpler recordkeeping for business purchases.

- Fairer application of high rates—only on luxury/sin goods.

Practical Impacts of the GST Update

- Medical insurance and education costs drop—GST now nil on most categories.

- Buying new electronics, small cars, kitchen appliances, motorcycles becomes easier on the pocket due to lowered GST tax rate.

- Only luxury spending and certain drinks/consumables get costlier.

- For businesses: compliance is easier, with faster processing and fewer disputes over tax rates.

New GST Rates List Highlights and Changes

The GST Council’s September 2025 reforms aren’t just about numbers—they’re about transparency, relief for the middle class, and business growth. Authorities have tracked market prices to ensure visible drops for customers, especially in food, essentials, and health. Only a limited set sees hikes (for lifestyle, luxury, or health-impacting products).

GST Rates in India—Current vs. New

Product Type | Previous GST | New GST Rate (from Sep 22, 2025) |

Basic Food Grains | 5-12% | Nil/5% |

Agri Inputs | 12-18% | 5% |

Medicines | 5-12% | Nil |

Health Equipments | 12% | 5% |

Processed Foods | 12-18% | 5% |

Electronics | 28% | 18% |

Motorcycles (≤350cc) | 28% | 18% |

Cars (≤1500cc) | 28% | 18% |

Pan Masala/Tobacco | 28-60% | 40% |

How-To: Quickly Find Your New GST Rate

- Check the product invoice or service bill.

- See if item falls under essential, standard, or luxury.

- Use official GST portals for guidance or smartphone GST apps.

- For complex products, ask your retailer or business supplier.

What Consumers Should Do After Rate Change

- Revisiting household budgets and potentially taking in account the savings on essentials goods.

- Comparing bills for pre- and post-September 2025 prices.

- Report anomalies in prices to authorities for resolution on a quick basis.

- For new car or appliance buyers, check for better deals!

Looking Ahead: Why Simple GST Rates Matter

This new gst rates list isn’t just a technical upgrade. It’s designed for convenience, savings, and clarity. Over time, expect business growth, healthier competition, and improved savings for households and entrepreneurs.

Conclusion: New GST Rate List Means Easier, Smarter Spending

September 22, 2025 marks a major change in India’s taxation story. With GST rates in India now lower for essentials and more streamlined overall, everyone from shopkeepers to families wins. Be sure to check the new gst rate list for your next bill, bank on more affordable basics, and let simpler tax filing brighten your Diwali and the months ahead.

FAQ'S

What changed in the gst tax rate structure?

Previous slabs (5%, 12%, 18%, 28%) has been modified into 5%, 18%, and 40%. Large number of items has been shifted towards lower rates.

Which essential items are now exempt or discounted?

Foods, dairy, many medicines, basic farm tools, healthcare and education services.

Will my electronics cost less now?

Most appliances such as fridges, TVs, washing machines has fallen down from 28% to 18%. Mobiles remain standard at 18%.

What are “sin goods” in the gst rates in india?

Up to 13 lots, totalling 780 shares, with required funds at upper price band approx. ₹1,92,660.

How do new gst rates help small businesses?

Lower taxes will help with cheaper inventories, quicker refunds, and simple and easy compliance.

Do farmers get relief under the new gst rates list?

Agri goods, farm tools drop from 12/18% to 5%, making them more affordable.

Any impact on education and insurance?

Education, life, and health insurance now attract Nil GST.

How do I check the new GST on my bill?

Item-wise GST printed—compare with three main brackets as above.