Tata Motors share price target 2024 - 30

Tata motors limited is part of the Tata group of companies and has established it self as a main automotive company across the world. Currently specializing in vehicles such as commercial vehicles, passenger cars, electric vehicles and luxury cars through the subsidiary Jaguar Land Rover, Tata Motors has shown tremendous ability to experience and survive in this competitive and dynamic world. When choosing the stock for investment, it is not enough to focus on modern results, immediate future expectations become essential, and the Tata Motors share prices direction is at the center of such conversations. Firstly, this blog reviews the historical performance of Tata Motors and its present standing and then outlines and presents the possible share price targets of Tata Motors for the years 2024-2030.

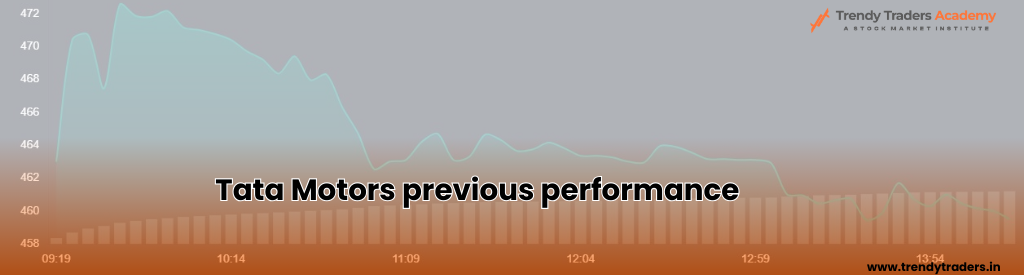

Tata Motors previous performance

For this reason, before predicting the future volatility of Tata Motors’ share price it will be better to consider its past performance. In the last decade, the company has gone through its triumphs and trials in terms of its cyclical fluctuation. There have been influences of the economic slowdown, the geo-political responses around the world, change in regulations and new trends among consumers.

2015-2020: This period was characterized by high fluctuation of Tata Motors share price. The company’s stock price came under pressure because Sales in two biggest markets for Jaguar, China and Europe were weak, and Increased regulatory pressures on JLR- Uncertainties over Brexit and new strict emission norms in Europe also pulled down the company’s stock price. The global pandemic in 2020 has worsened the challenges of the stock that lowered to around INR 64 in March 2020.

2020-2023: Considering the given period, Tata automotive group started to improve after the COVID-19 breakout. That is why the company implemented a strategic transformation programme of cost reduction, efficient debt management and transition to electric vehicles production. This approach was favored by the market and by the end of 2023, the share price had risen to over INR 600 indicating that the investors have more confidence in the company’s future growth particularly in the EV segment.

Factors Impacting Tata motors Share price target

Some important variables that will define the movement of Tata Motors’ stock price between the years 2024 to 2030 include the following. Macroeconomic factors and geopolitical issues are included in these factors as well as the company specific factors that involve strategies.

Electric Vehicle (EV) Expansion: Tata motors has not left behind in the EV segments it has also invested a good amount of funds in this segment as they want to capture the market of green vehicles. The latest and upcoming electric vehicles models such as Tata Nexon EV, Tigor EV and other upcoming products have established the company in the Indian EV market. Besides, the government’s commitment toward promoting electric mobility through incentives, infrastructure, and policies reinforces this view.

Jaguar Land Rover (JLR) Performance: For Tata motorsJLR is a cash cow because it contributes huge revenue or we can call International earning for Tata Motors from Countries China, USA and European countries will significantly affect the share price. One of those critical forces will be the implementation of JLR’s “Reimagine” plans outlined to lean towards the electrification and sustainability of its vehicles while maintaining luxury branding. Investors are set to find new electric models and a shift towards a more sustainable product portfolio attractive.

Debt Reduction and Financial Health: The company has been vulnerable to the debt matter for some time now and has been striving hard to improve on this factor, which appears to have been positively received in the market. This is why it is always important to maintain a balance sheet that is healthy and strong since it can take a very long time to build such a capital intensive business as the automobile industry. Thus, the further development of the company specifically in terms of its debt, cash flow and profitability will play an important role for the share price.

Global Automotive Trends and Regulatory Landscape: Today’s automotive world is going through the phase of transition due to technology innovation, demand changes, and increased regulatory compliance. Some trends of the transformation of the automobile industry are still prospective for Tata Motors, including not only autonomous driving but connectivity and other types of fuel, too. Further, the legal environment of the industry such as the emission norms, safety norms, and international trade policies would have a great impact on the performance of the company.

Macroeconomic Factors and Market Sentiment: Industry-wide factors, especially the interest rate, inflation rate, and GDP will determine the Tata Motors share price. Market sentiment arising as a result of geopolitical factors, changes in trade policies and the confidence including that of institutional investors as well will also be significant. For instance, Macro environmental factors, such as improved interest rate and economic growth synchronized with macro micro factors where consumers spend more on automobiles will be befitting for Tata Motors.

Tata motors share price target 2024 - 2030

Estimation of the proportion of the future share price in Tata Motors requires qualitative and quantitative techniques such as fundamental analysis in excess to technical analysis as well as the actual market sentiment. Although these projections are not exact due to outside influences and change with outside forces these are good general estimating of what prices could be.

2024-2025: Consolidation and Growth Phase By the year 2024, Three key strategies will characterize the operationalization of this cycle Consolidation & growth phase: In the consolidation and growth phase by the year 2024, Tata Motors’ EV portfolio will be broader than now, and its market penetration will have increased significantly. The envisaged strategies by the company include partnership in battery technology, charging infrastructure and increasing the capacity of EV production hence pegged for good performance. For instance, the share price could go as low as 850 and as high as 1200, based on the successful implementation of the above stated plans and improvement in the operations of JLR.

2026-2027: Doubling Down on Growth and Dominance As Tata Motors ramps up on EV production and also comes up with new models in the passenger and commercial automobile segments, it is expected that the company’s market share will expand significantly. Once more, the growth of electrification as well as luxury sustainability in JLR is expected to reward within this period to offer the total valuation the essential increase. Some analysts believe that it could go up to Rs 1450-1,620 on the back of vibrant EV segment expansion, better financials, and favourable investor sentiment.

2028-2030: Maturity and Global Expansion By 2028-2030, Tata Motors is expected to be at the center of EV and automotive business world. This long-term focus on innovation, sustainability, and customer solutions will help the company to capitalize on appearances. Other opportunities include strategic acquisitions, partnership, and market expansion to further strengthen that position. Therefore under these developments it can set its sights on reaching a share price of between INR 1,800 – 1,950 or more provided the market supports it and successful implementation of the long-term strategy is achieved.

Tata Motors share price target 2024 - 30

Financial Year | Expected Price | Reason |

2024 – 25 | As low as Rs. 850 as high as Rs. 1200 | This price is based on the successful implementation of stated plans and improvement in the operations of JLR. |

2026 – 27 | Could Range between 1450-1620 | This price is expected because tata ramping up its EV production in base as well as its premium segment of JLR which will help in investor trust and support |

2028 – 30 | Could range between 1800-1950 | Aim of tata motors to become 100% EV manufacturing will require immense Innovation and suntained technology. And by 2030 low battery cost will help to maintain its cost effectiveness. |

Key Risks and Challenges with Tata Motors Share Price

While the outlook for Tata Motors appears promising, several risks could potentially affect its share price trajectory

Economic Slowdown: The condition in the market; global or domestic affects the buyer’s affordability towards automobiles and this may affect the sales of Tata Motor vehicles and by extension its profitability.

Supply Chain Disruptions: Other hindrances that are characteristic of auto construction including supply of semiconductors, increase and cost of raw materials and transportation might pose a threat to the production process and profitability of the firm.

Intense Competition: Automotive industry is quite intensively matured and there are plenty of competitors on the market, especially in the growing EV market segment. To sustain such a position in the market Tata motors is going to reinvent itself and offer quality products to the market.

Regulatory Risks: Some of the other factors that can influence the operations and the cost structures of the company include governmental policies in areas of taxation, emissions, safety standards, etc.

Geopolitical Tensions: Political: Geopolitical risks and conflict, trade wars, changes in custom duties: JLR has a large share of its operations in international markets and therefore risk of political volatility affects the growth of the company.

Tata motors therefore finds itself at crossroads in its expansion strategy in the current global market as the uptrend on electric vehicles continues to surge. Based on the industry trends and the management plans of the company, including the strategies, innovation, and financial awareness it is anticipated that its share price of the company will grow in the next ten years. As with any investment there is always inherent risk and difficulties but the opportunities for growth remain enticing which make Tata Motors an interesting investment for those willing to have a long term horizon.

Tata Motors’ plan for the years 2024-2030 will be determined by its capacity to shift towards new possibilities, composing value for shareholders. So the intuitive phase for investors will be to pay attention to the strategic directions, and market and economic conditions in order to optimize the exciting phase of growth.

Note: We are not SEBI Registered Advisors, these are just for Educational purpose. Please consider your Financial Advisor before any investment.

Also Read : Companies listed in National Stock Exchange

FAQ'S

What is Share price of Tata Motors

Tata Motors is currently trading at Rs. 965 per share as of now. It is expecting little more dip due to JLR announcement

Who owns Jaguar and Land Rover?

Jaguar and Land Ranger are owned by Tata motors acquired from Ford motors in 2008.

Should we Invest in Tata Motors?

Tata Motors is one of the leading Vehicle manufacturing companies in India. It is Focusing on EVs and has plans to dominate the EV sector in India.

What is Tata Motors Share Price Target by 2030?

By seeing its current growth and Historical Data it is not very surprising that Tata Motors is doing well and its ambitions are big. In favorable conditions its share price can reach between Rs.1800-1950 Per share.